Understanding GST Payment: Importance and Process

Introduction

The Goods and Services Tax (GST) has become a significant component of India’s taxation system since its implementation in July 2017. Replacing a myriad of indirect taxes, GST aims to simplify the tax structure while enhancing compliance among businesses. Understanding the GST payment process is crucial for both businesses and taxpayers, as timely payments directly impact cash flow and compliance status.

Importance of GST Payment

GST payments are crucial as they ensure that governments at the central and state levels have the revenue required for public services and infrastructure development. Delays or defaults in GST payment can lead to penalties, interest, and even litigation, making it essential for businesses to maintain a clear understanding of their tax obligations. Additionally, timely payments establish good standing with tax authorities and can lead to smoother audits and returns processes.

Process of Making GST Payments

The GST payment process involves several steps:

- GST Portal Registration: Businesses need to register on the GST portal to obtain a GST Identification Number (GSTIN), which serves as the unique identifier for tax purposes.

- Calculate GST Liability: Once registered, businesses must calculate their GST liability based on the sales and purchases made during the taxation period.

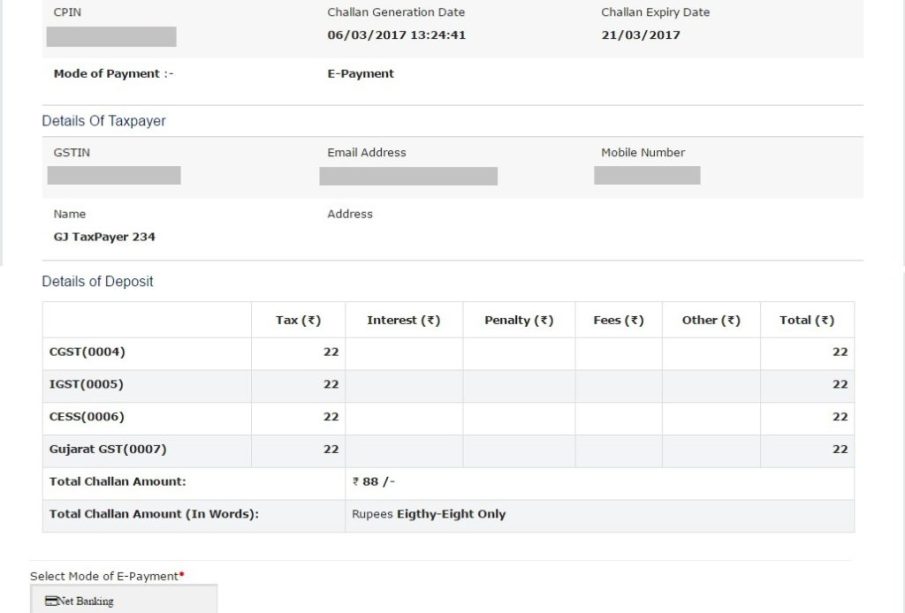

- Generate Challan: After calculating the liability, the taxpayer must generate a payment challan on the GST portal. This electronic document states the amount due and provides a reference for payment.

- Make the Payment: Payments can be made through various methods including online banking, NEFT, RTGS, or through authorized banks. Once the payment is made, an acknowledgment receipt is generated.

- Filing Returns: Post-payment, businesses are required to file their GST returns, detailing the transactions and the taxes paid.

Recent Updates

As of October 2023, the Indian government has taken significant steps to enhance the GST payment infrastructure. The introduction of the new GST return system aims to simplify the filing process. Moreover, periodic updates to the payment portal have improved user experience and reduced transaction failures.

Conclusion

Understanding the GST payment process is vital for all business owners and taxpayers in India. As GST continues to evolve, staying informed about compliance requirements ensures that businesses can avoid penalties and enjoy the benefits of a streamlined taxation system. Regular audits and updates from the government highlight the need for businesses to remain aware and contributory in this vital economic framework. Looking forward, with technological advancements, the GST system may witness further simplifications, making payments even more accessible and user-friendly.