Understanding GST Payment: A Guide for Taxpayers

Introduction

Goods and Services Tax (GST) is a significant reform in the Indian taxation system, aimed at streamlining tax structures and enhancing compliance. GST payment is crucial for businesses and individuals alike, as it affects pricing, compliance, and overall economic stability. Understanding how GST payments operate is essential for taxpayers to avoid penalties and ensure fluid business operations.

Current Overview of GST Payment

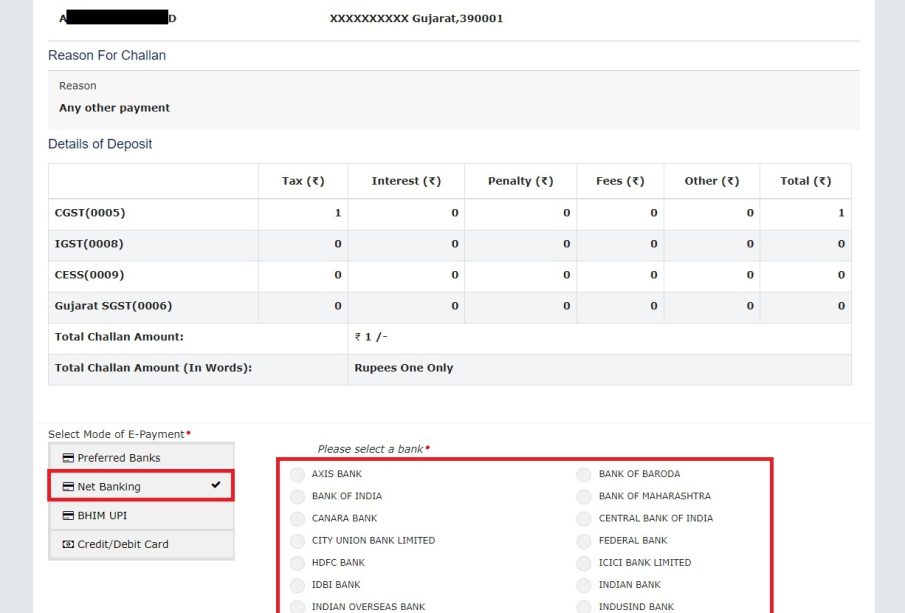

As of October 2023, the GST Council has taken several steps to simplify the payment process for taxpayers. One of the key features introduced is the GST portal, which allows businesses to file their GST returns and make payments digitally. This online system is designed to enhance transparency and ease the process, promoting timely compliance among taxpayers.

The payment of GST is divided into three categories: Central GST (CGST), State GST (SGST), and Integrated GST (IGST). While CGST and SGST are applicable for intra-state sales, IGST is applicable for inter-state sales. Correctly categorizing your GST payments is vital for compliance and upcoming audits.

Recent Developments

In recent months, the GST Council has also focused on addressing concerns regarding GST payment defaults and discrepancies. The government has been actively working to reduce instances of tax evasion, which includes implementing advanced analytics to track GST transactions. These measures have led to an increase in compliance rates, benefitting the overall economy.

Conclusion

In conclusion, GST payment is a critical aspect of the Indian taxation landscape, with ongoing changes aimed at making it more accessible and efficient for taxpayers. With the government’s commitment to promoting digital payment methods, it is expected that the efficiency and compliance rates will further improve in the coming years. Taxpayers are urged to stay informed about their responsibilities and utilize available resources to ensure timely payments and adherence to regulations. Understanding the nuances of GST payment not only aids in compliance but also fosters a more favorable business environment.