Understanding FII Data and Its Impact on Indian Markets

Introduction to FII Data

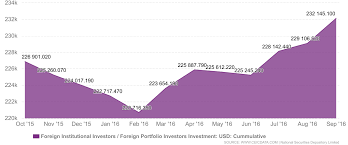

Foreign Institutional Investors (FIIs) play a critical role in the Indian financial markets, influencing economic growth and stock market trends significantly. As India continues to attract foreign capital, understanding FII data becomes essential for investors and stakeholders alike. This data not only reflects the sentiments of global investors but also aids in predicting trends that can influence local market dynamics.

Current Trends in FII Investments

Recently, the latest FII data has shown a notable increase in foreign investments in the Indian stock market. In the month of October 2023 alone, FIIs infused approximately INR 9,000 crores into the equity market, reflecting a strong positive sentiment towards India’s economic recovery post-pandemic. This increase can be attributed to several factors, including stable political conditions, economic reforms, and a robust growth outlook.

Recent reports indicate that sectors such as technology and pharmaceuticals have been the primary beneficiaries of these investments. The government’s initiatives aimed at digitalization and healthcare have also attracted significant FII interest, signaling confidence in the long-term potential of these industries.

Significance of Monitoring FII Data

The monitoring of FII data is not just for analysts and fund managers; it serves as a valuable tool for individual investors as well. FII participation is often a precursor to market trends; hence, an uptick in FII investments may indicate a bullish trend ahead. Conversely, a decrease can signal caution. This predictive aspect makes it vital for investors to stay updated with the latest FII figures and trends.

Conclusion and Future Outlook

In conclusion, FII data remains a key indicator of market sentiment and investment trends in India. As we move towards 2024, analysts predict that as global economic conditions stabilize, FII inflows may continue to rise, potentially leading to more sustainable growth within the Indian economy. Investors are advised to keep a close watch on these trends, as they offer valuable insights when making informed investment decisions in an ever-evolving market landscape.