Understanding FII Data and Its Impact on Indian Markets

Introduction to FII Data

Foreign Institutional Investors (FIIs) play a significant role in the Indian stock market, contributing to the liquidity and stability of the financial ecosystem. The FII data reflect the investments made by foreign entities and provide insights into market trends, investor confidence, and economic outlook. With the resurgence of interest in Indian equities post-pandemic, the analysis of FII data has become increasingly critical for investors and analysts alike.

Recent Trends in FII Data

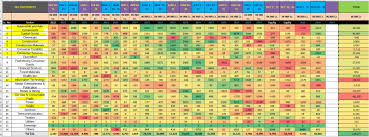

As of October 2023, recent reports indicate a robust influx of foreign investment into Indian markets. According to the National Securities Depository Limited (NSDL), FIIs have invested over INR 25,000 crore in equities during September 2023 alone, marking a sharp increase compared to previous months. This trend is attributed to high growth potential in the Indian economy, improved corporate earnings, and global investors seeking diversification in emerging markets.

Furthermore, a key observation from the FII data is the shift in investment patterns. Sectors such as technology, pharmaceuticals, and consumer goods are witnessing heightened interest, reflecting global trends and changing consumer behaviors. The ongoing digitization in various sectors, especially post-COVID-19, has encouraged foreign investors to tap into India’s growing technology landscape.

Influence of Global Factors

It is essential to understand that FII data does not exist in a vacuum; it is influenced by global economic factors such as inflation rates, geopolitical tensions, and changes in monetary policy by developed nations. For instance, fluctuations in U.S. interest rates or instability in European markets can significantly impact FII investment flows into India. As the Federal Reserve hints at potential rate hikes, analysts are closely watching how this will affect foreign investment trends in the coming months.

Conclusion and Future Outlook

In conclusion, the FII data underscores the growing confidence of foreign investors in the Indian economy. As we move towards the end of 2023, experts anticipate that this trend will continue, provided that domestic economic conditions remain favorable and geopolitical tensions stabilize. Investors should keep a close eye on these data releases and global events to make informed investment decisions. Understanding FII trends is not just beneficial for institutional investors but is also crucial for retail investors looking to navigate the complexities of the stock market in India.