Understanding FII Data and Its Impact on Indian Markets

Introduction

Foreign Institutional Investors (FIIs) play a crucial role in the Indian economy, significantly influencing market trends and investor confidence. As per the latest reports, FIIs have made substantial investments in various sectors, highlighting their confidence in India’s economic outlook. This article delves into the recent trends in FII data, its implications on the stock market, and what it signifies for potential investors.

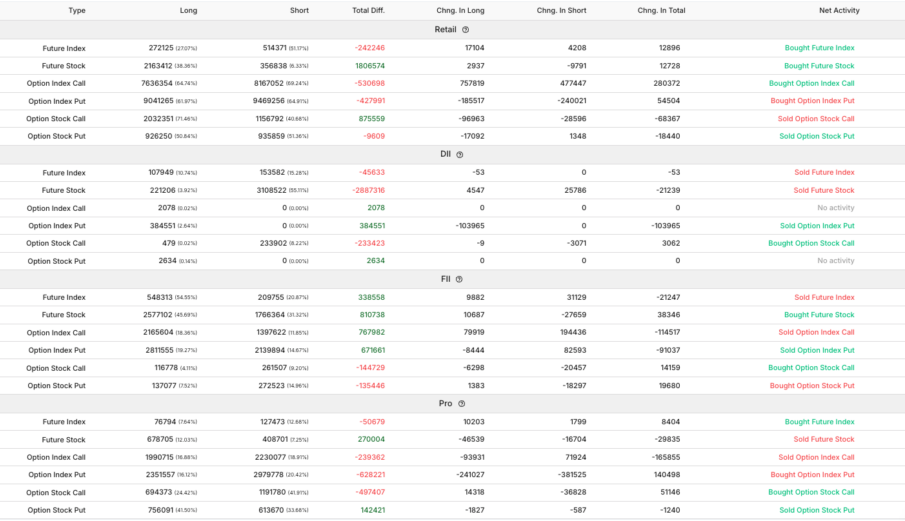

Current Trends in FII Data

According to the National Securities Depository Limited (NSDL), FIIs infused over ₹1.5 lakh crore in Indian markets in the year 2023 alone, signaling a marked increase from the previous year. This inflow is attributed to several factors, including the resilience of the Indian economy post-pandemic, government reforms, and attractive valuations of Indian stocks compared to global markets.

The sectors attracting the most FII interest include technology, pharmaceuticals, and renewable energy. For instance, during the last quarter, the technology sector witnessed a 25% increase in FII investments, indicating a growing trust in the digital transformation agenda of India.

Impact on Stock Markets

The influx of FII capital has consistently demonstrated its positive impact on the Indian stock markets. The Nifty 50 and BSE Sensex indices have reached record highs, driven by this foreign capital. Financial analysts report that the confidence shown by FIIs is often seen as a barometer for retail investors, leading to increased domestic buying and further boosting market sentiment.

However, this high level of investment also comes with caution. Financial experts advise that excessive reliance on FII flows can lead to volatility, especially if global economic conditions change unexpectedly, causing FIIs to withdraw capital. Recent global economic shifts, including changes in US monetary policy, highlight the interconnectedness of global markets and the potential risks involved.

Conclusion

In summary, FII data serves as a critical indicator of foreign investor sentiment towards India’s economy and market stability. With significant investments pouring in, the current scenario reflects a robust recovery of financial confidence in India. For potential Investors, keeping a close watch on FII trends can provide valuable insights into market movements and investment strategies. As India continues to evolve as a promising hub for international investments, understanding FII activities will be crucial for making informed financial decisions.