Understanding EPF Passbook: Importance and Access Guide

Introduction

The Employees’ Provident Fund (EPF) is a crucial savings scheme for employees in India, administered by the Employees’ Provident Fund Organisation (EPFO). The EPF Passbook serves as a vital tool for employees to monitor their contributions and understand the growth of their retirement savings. With increasing awareness about financial literacy and retirement planning, familiarizing oneself with the EPF Passbook is essential for employees across sectors.

What is an EPF Passbook?

The EPF Passbook is an online document that records the contributions made by both the employee and the employer towards the EPF account. This passbook provides a transparent overview of the funds accumulated, including interest earned on the balance. Employees can access their passbook to track yearly contributions, check the current balance, and confirm that contributions are being made regularly.

How to Access Your EPF Passbook?

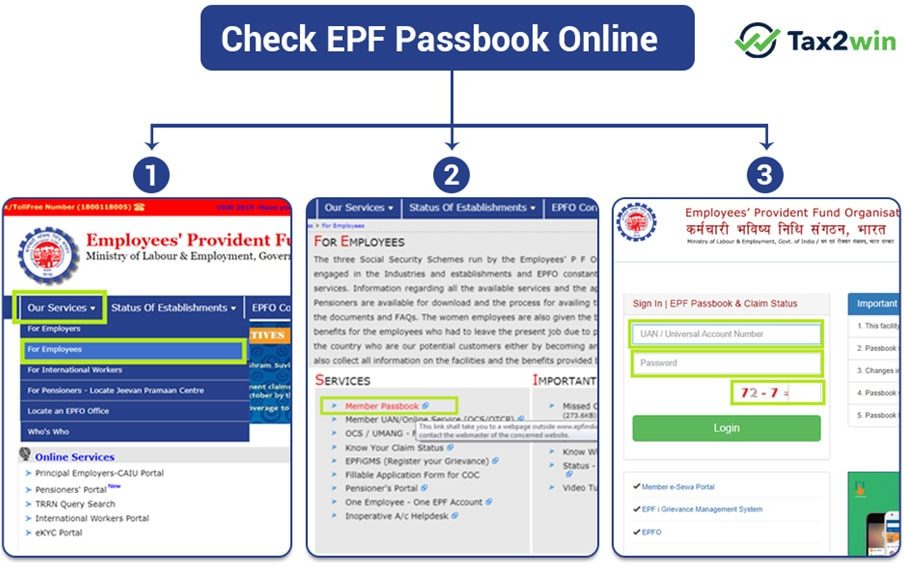

Accessing your EPF Passbook is easy and can be done in a few simple steps:

- Visit the EPFO Website: Go to the official EPFO website (epfindia.gov.in).

- Login to Member Portal: Navigate to the ‘Member’ section and log in using your Universal Account Number (UAN) and password.

- Download Passbook: Once logged in, click on ‘EPF Passbook’ to view and download your passbook. Ensure that your UAN is activated and linked with your Aadhaar number for seamless access.

Importance of EPF Passbook

The EPF Passbook is not only a record of transactions but also plays an important role in financial planning. Here are several reasons why it is important:

- Transparency: It provides clarity on contributions, ensuring that both employees and employers meet their respective obligations.

- Financial Planning: By keeping track of contributions and interest, employees can plan for their retirement more effectively.

- Facilitates Withdrawals: A well-maintained passbook is essential during the withdrawal of funds upon job change or retirement.

Conclusion

In a fast-evolving world, understanding your finances becomes paramount, and the EPF Passbook is a central element in managing your retirement savings. By regularly monitoring your EPF Passbook, you not only gain insights into your funds but also enhance your financial literacy. As the government encourages digital access to information, employees must take advantage of the EPF’s online services to ensure their financial security as they approach retirement.