Understanding Dow Jones Through Moneycontrol: Key Trends and Insights

Introduction

The Dow Jones Industrial Average (DJIA) is one of the most tracked stock indices globally, serving as a barometer for the U.S. stock market’s overall performance. With investors and analysts closely monitoring its fluctuations, platforms like Moneycontrol provide critical insights and data for informed investment decisions. Understanding how the DJIA operates and its current trends is vital for both seasoned and novice investors in navigating the stock market.

Current Market Trends

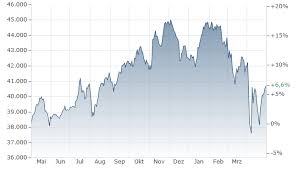

As of October 2023, the Dow Jones has been experiencing a mix of volatility and growth. Recent weeks have seen the index rising sharply, driven by positive earnings reports from major corporations. Analysts noted a significant uptick in technology and healthcare stocks, which have helped buoy the index despite ongoing concerns about inflation and geopolitical tensions. Moneycontrol’s real-time tracking of the DJIA provides users with immediate access to market data, making it easier for them to gauge market sentiments.

Factors Influencing the Dow Jones

The performance of the Dow Jones is influenced by a variety of factors, including economic indicators, corporate earnings, and external global events. Recent data released by the U.S. Labor Department indicates a strong job market, which has boosted investor confidence. Furthermore, corporate earnings have largely exceeded expectations for the third quarter, with many companies reporting growth amidst rising consumer spending.

Moneycontrol’s Role in Investor Decisions

Moneycontrol is a key resource for many investors, offering a comprehensive suite of tools for analysis and tracking stock performance, including the DJIA. The platform provides users with historical data, expert commentary, and detailed analysis, allowing for a deeper understanding of market movements. Users can access interactive charts and personalized watchlists, aiding in strategic decisions.

Conclusion

As the Dow Jones continues to demonstrate resilience in response to economic shifts, platforms like Moneycontrol remain essential for investors. The insights, real-time data, and analysis available on Moneycontrol can empower investors to make informed decisions in a rapidly changing market landscape. As we look ahead, it is crucial for investors to stay updated with market trends and leverage the resources provided by financial platforms to navigate their investments effectively.