Understanding Dow Jones Futures: Recent Trends and Insights

Introduction

Dow Jones futures play a crucial role in indicating the anticipated performance of the financial markets. These futures originate from the Dow Jones Industrial Average (DJIA), which is a critical benchmark for stock market performance in the United States. Understanding how these futures fluctuate can provide investors with insights into market trends, helping them make informed decisions amid a dynamic economic environment.

Recent Developments

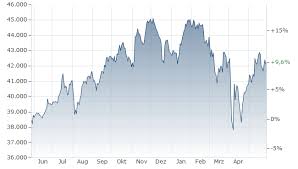

As of October 2023, the Dow Jones futures have seen significant volatility due to a mixture of economic data releases and geopolitical tensions. Recent reports from the U.S. Labor Department indicated a decrease in unemployment rates, which initially boosted investor sentiment. However, inflation concerns persisted, as consumer prices remained higher than the Federal Reserve’s target of 2%. This has led to mixed signals in the futures market.

In addition, ongoing international conflicts, especially the geopolitical tensions in Eastern Europe and the Middle East, have also contributed to uncertainties in the global markets. This has made traders more cautious, causing fluctuations in Dow futures. For instance, after an announcement about potential sanctions against a major trading partner, Dow futures plummeted, highlighting how external factors can drastically impact market expectations.

Market Performance and Predictions

Financial analysts are closely watching the 35,000 mark for the DJIA as a vital psychological level. With recent earnings reports from major corporations being released, experts predict a mixed performance in the upcoming quarters. Some companies have exceeded expectations, driving optimism in the tech sector, while others have reported underwhelming results, especially in the retail market due to changes in consumer behavior. Traders should remain alert as earnings season progresses, as this can lead to heightened volatility in Dow futures.

In Conclusion

The analysis of Dow Jones futures can provide critical insights into the potential movement of the stock market. As we move forward, investors should keep an eye on economic indicators such as inflation rates and employment figures, as well as international developments that could influence market stability. The current climate shows a fluctuating market landscape, making it imperative for investors to stay adaptable and informed.