Understanding Dmart Share Price Trends and Impact

Introduction

The share price of Dmart, officially known as Avenue Supermarts Ltd, has garnered significant attention in the stock market due to its rapid growth and expansion across India. As one of the leading retail chains in the country, understanding Dmart’s share price movements is crucial for investors and market analysts alike. With retail industry dynamics shifting and evolving, the valuation of Dmart provides essential insights into consumer behavior and economic trends.

Current Market Position

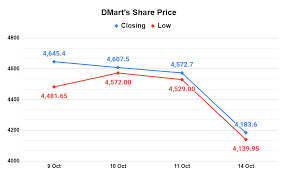

As of October 2023, Dmart’s share price has shown stability amidst fluctuating market conditions. As per the latest reports, the share price is hovering around INR 4,000, reflecting a steady performance since the beginning of the fiscal year. Various factors such as increased consumer spending and strategic expansion plans have contributed to the stock’s resilience. Analysts note that Dmart’s robust business model, which focuses on low operational costs and high-volume sales, continues to bolster investor confidence.

Recent Developments

Dmart has recently announced plans to open new stores in tier-2 and tier-3 cities, aiming to tap into the growing urban and semi-urban consumer base. This expansion strategy is anticipated to drive revenue growth and support a positive outlook on the share price. Additionally, the company reported a 15% increase in year-on-year sales in its latest quarterly earnings, which is an encouraging sign for shareholders.

Market Forecast

Looking ahead, several analysts project a bullish trend for Dmart’s share price, projecting potential growth to INR 4,500 in the next 12 months, supported by sustained profitability and market expansion. However, they also advise caution, highlighting external risks such as supply chain disruptions and competition from emerging grocery delivery services, which could impact future performance. Investors are encouraged to keep abreast of market conditions and Dmart’s strategic decisions that may influence share price in the subsequent quarters.

Conclusion

Dmart’s share price remains a focal point for investors, reflecting both the company’s longstanding success and the evolving landscape of Indian retail. While the current outlook appears promising, potential investors should remain aware of both the opportunities and challenges ahead. Keeping an eye on Dmart’s operational strategies and market trends will be essential for understanding the stock’s future trajectory.