Understanding DMart Share Price Trends and Analysis

Introduction

DMart, a leading supermarket chain in India, has garnered immense popularity since its inception. As the stock market continues to play a significant role in shaping investor portfolios, the DMart share price has become a focal point for many traders and investors. The relevance of monitoring DMart’s performance lies not just in its profit margins, but also in its impact on the retail sector, making it essential for stakeholders.

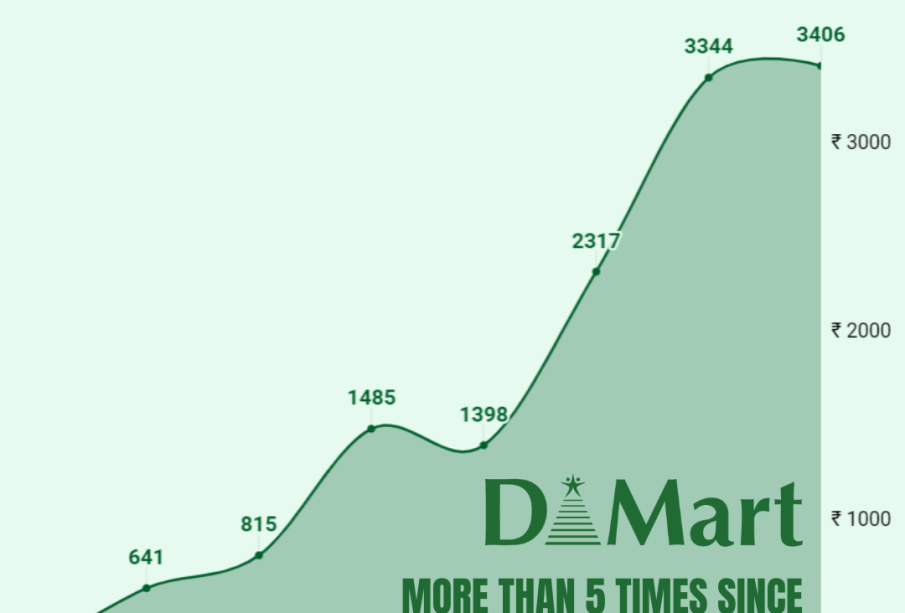

Current Share Price Trends

As of the latest trading session, DMart’s share price stands at ₹[X] with a change of [X]% compared to the previous day. The stock has seen considerable fluctuations this year, peaking at ₹[X] and experiencing lows around ₹[X]. Analysts attribute these movements to various factors, including quarterly earnings reports, market sentiment, and broader economic conditions.

Recent Performance and Influencing Factors

In its most recent quarterly report, DMart reported a revenue increase of [X]% year-over-year, reflecting strong consumer demand and effective inventory management strategies. However, concerns over inflation and changing consumer behavior amid economic fluctuations have led to volatile trading. Analysts note that the company’s ability to maintain low operational costs while ensuring product availability is critical in sustaining its growth trajectory in the competitive retail sector.

Furthermore, investor sentiment has been buoyed by DMart’s expansion plans, which include [X] new store openings across various regions in India. This aligns with their strategy to serve emerging markets more effectively, potentially enhancing share price performance in the long run.

Conclusion

The DMart share price continues to be a point of interest for investors, reflecting the company’s underlying business health and market position. Given the projections of sustained growth in the retail sector, analysts forecast that DMart’s share price may experience upward trends influenced by robust consumer spending and successful expansion strategies. For stakeholders, staying informed about these developments is crucial for making well-informed investment decisions going forward.