Understanding Dabur Share Price: Trends and Analysis

Importance of Dabur Share Price in the Market

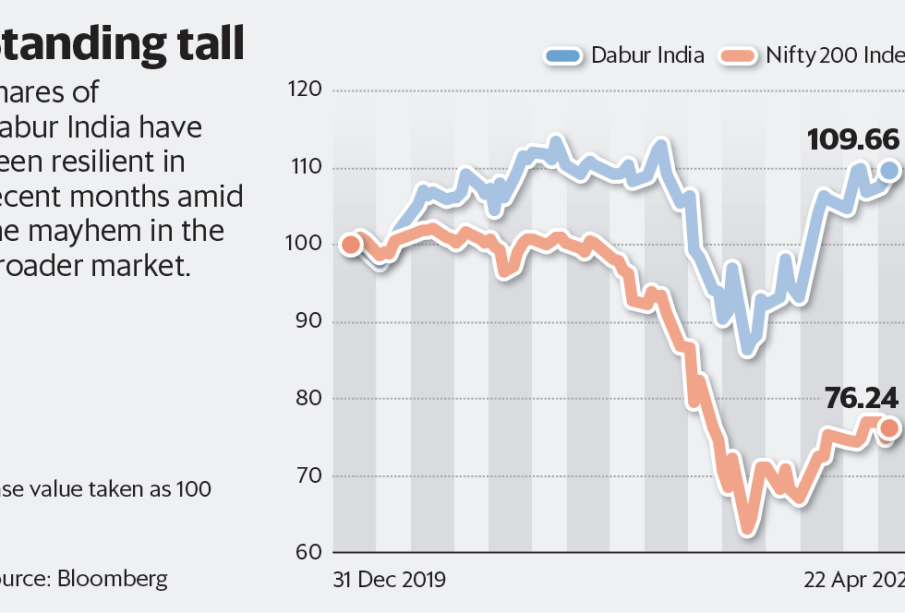

Dabur India Ltd, one of the leading consumer goods companies in India, has garnered significant attention due to its share price fluctuations. Understanding its share price movements provides insight into the broader market trends and the company’s financial health. As investors and stakeholders anticipate future performance, monitoring the share price of Dabur becomes crucial in making informed investment decisions.

Current Performance Overview

As of the latest trading session, Dabur’s share price has been experiencing a notable period of volatility. Currently trading at approximately ₹560, the stock reflects a year-to-date gain of around 12%. Analysts attribute this positive trend to strong quarterly earnings, driven by robust sales in both domestic and international markets. The company’s emphasis on expanding its product line and reaching newer demographics has been well-received in the market.

Factors Influencing Dabur’s Share Price

Several factors play pivotal roles in determining the fluctuations in Dabur’s share price:

- Market Sentiment: The overall sentiment in the FMCG sector affects Dabur’s stock significantly. Positive news around consumer spending has bolstered confidence among investors.

- Company Earnings: Recent quarterly results indicate a 15% growth in revenue, which has led analysts to boost their target prices for the stock.

- Competition and Market Share: With increasing competition in the health and wellness segment, Dabur’s ability to maintain and grow its market share is constantly scrutinized by investors.

Outlook and Future Trends

Looking ahead, analysts predict that Dabur’s share price may experience further growth. The company has plans for strategic expansion, including its penetration into new markets and a focus on sustainable and natural products, aligning with the growing consumer preference for organic and herbal products. However, potential volatility remains as global economic conditions could impact consumer behavior.

Conclusion

In conclusion, monitoring the Dabur share price is essential for investors seeking to navigate the Indian stock market. While current trends indicate a favorable outlook due to strong performances and strategic growth initiatives, potential risks remain. Investors are urged to keep a close watch on market dynamics and company developments that may affect Dabur’s future share prices. As trends evolve, staying informed will be key in ensuring optimal investment strategies.