Understanding Cryptocurrency Trading: Basics and Risks

Introduction: Importance and Relevance

Cryptocurrency trading has become an important topic for investors, technologists and regulators worldwide. For readers in India, understanding cryptocurrency trading is relevant because it intersects with digital adoption, financial inclusion and evolving regulation. Clear, neutral information helps individuals evaluate opportunities and risks without offering financial advice.

Main body: Key Facts and Practical Details

What is cryptocurrency trading?

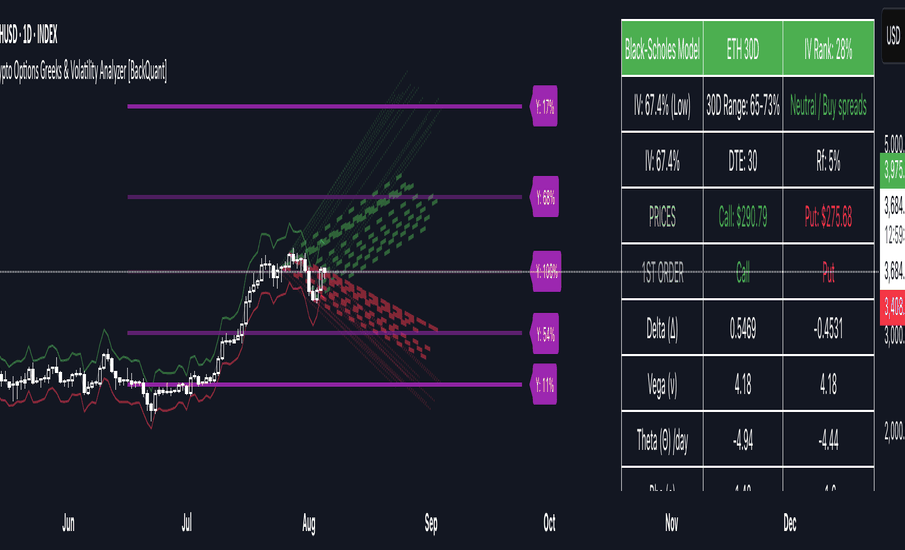

Cryptocurrency trading is the act of buying, selling or exchanging digital assets such as cryptocurrencies on exchanges or peer-to-peer platforms. Traders may seek short-term profits through price movements or longer-term exposure to specific blockchain projects. Trading can take many forms, including spot trading (direct buying and selling), derivatives, margin trading and automated strategies.

How trading works

Most trading happens on centralized exchanges or decentralized exchanges (DEXs). Centralized exchanges provide order books, custody services and often customer support; DEXs enable direct wallet-to-wallet transactions using smart contracts. Trades require a digital wallet, account verification on many platforms and an understanding of order types (market, limit, stop-loss).

Security and operational considerations

- Use reputable exchanges with transparent fees and security practices.

- Enable strong account protection: two-factor authentication, hardware wallets for long-term holdings, and careful key management.

- Be aware of phishing, scams and social-engineering risks common in this ecosystem.

Regulation and taxation context

Cryptocurrency trading operates in a changing regulatory environment. Traders should follow applicable laws, know tax obligations and keep records of transactions. Regulatory clarity is evolving in many jurisdictions; staying informed through official sources helps manage compliance risk.

Risk management and strategy

Markets for cryptocurrencies are typically volatile. Effective risk management includes position sizing, diversification, use of stop-losses, and avoiding leverage unless fully understood. Educational resources and simulated (paper) trading are useful for newcomers.

Conclusion: Implications and Outlook

Cryptocurrency trading remains an active and rapidly changing area. For readers, the immediate takeaway is to seek neutral information, prioritize security and compliance, and approach trading with clear risk management. Looking ahead, market developments, technological advances and regulatory decisions will shape trading practices; staying informed will be essential for anyone engaging with cryptocurrencies.