Understanding Coal India Share Trends and Forecasts for 2023

Introduction

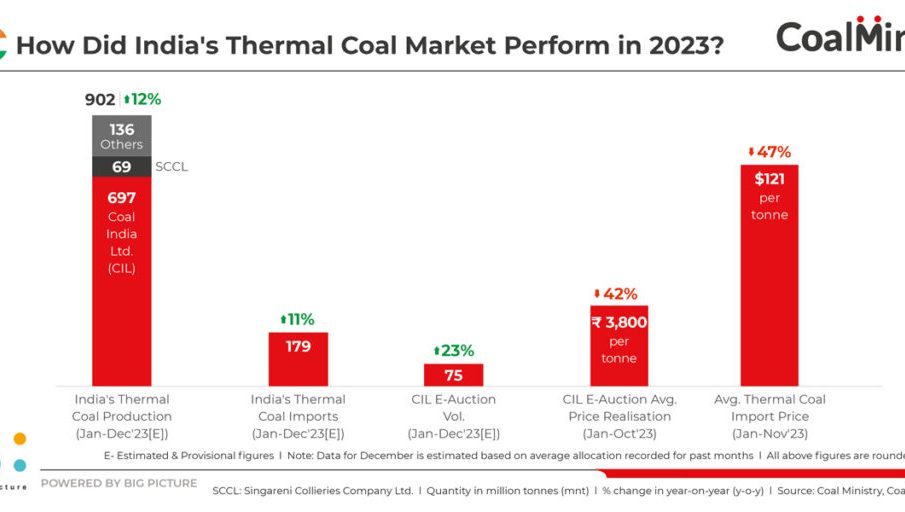

Coal India Limited (CIL) is the largest coal-producing company in the world and a crucial player in India’s energy sector. With coal being a significant source of energy in India, the performance of Coal India shares has garnered significant attention from investors. Understanding the trends and developments surrounding Coal India shares is essential for current and potential investors, especially as the company navigates regulatory changes and global market fluctuations in 2023.

Current Performance of Coal India Shares

As of October 2023, Coal India shares have shown a volatile trend influenced by several factors. In the last quarter, shares have seen a rise of approximately 10% due to increased demand for coal and the government’s push for enhanced coal production. Analysts suggest that the stock price’s growth reflects recovery from the pandemic’s impact and a rejuvenated focus on energy security amid rising global energy prices.

Factors Influencing Share Prices

Several elements are influencing Coal India shares:

- Global Energy Demand: With the world still reliant on coal, especially in emerging economies, demand for Coal India products remains robust.

- Government Policies: The Indian government has been actively promoting greater production targets for Coal India through initiatives that aim to enhance domestic coal output. This policy shift is likely to boost investor confidence.

- Environmental Concerns: With the global shift towards renewable energy, environmental concerns surrounding coal production could impact long-term share performance. Investors need to be aware of the company’s sustainability measures.

- Market Competition: Increasing competition from renewable energy sources may pressure coal companies, including Coal India, to innovate and improve efficiency.

Future Outlook

Looking ahead, analysts predict that Coal India shares could see moderate growth, provided the company effectively addresses environmental sustainability and adapts to the changing energy landscape. If the government continues to support coal production while managing environmental concerns, investors may find opportunities in Coal India shares. However, potential investors should remain cautious of regulatory risks and fluctuations in global energy prices.

Conclusion

Overall, Coal India shares remain a focal point for many investors amidst shifting market dynamics and energy policies. For those looking to invest, staying informed about industry trends and government regulations will be crucial. As coal remains a vital energy source in India, understanding the trajectory of Coal India’s shares can provide valuable insights into the broader energy market landscape.