Understanding BSE Small Cap: Insights and Trends

Introduction

In the dynamic world of the Indian stock market, small-cap stocks play a crucial role in driving growth and investor interest. The BSE Small Cap index, a benchmark for smaller listed companies, has gained significant attention from market participants in recent years. It represents companies with lower market capitalizations than the larger counterparts, making it a breeding ground for high growth potential.

Current Performance of BSE Small Cap

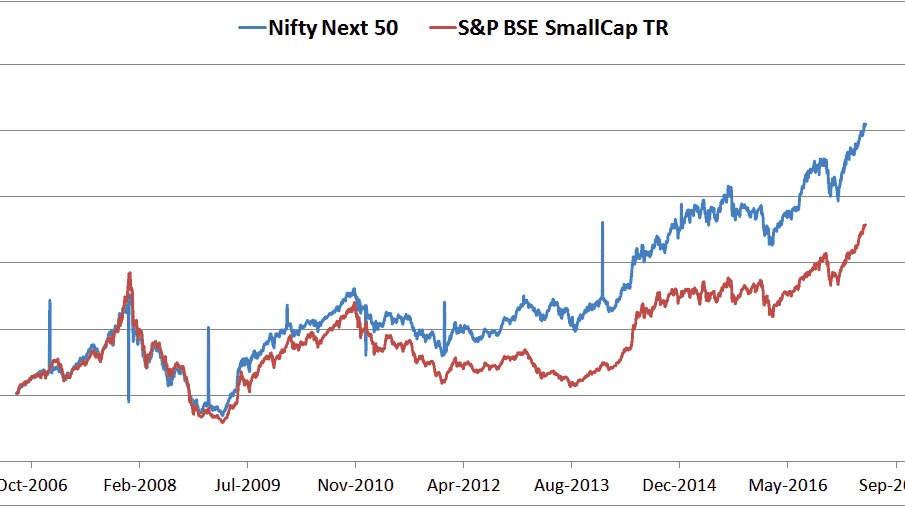

As of October 2023, the BSE Small Cap index has shown a remarkable uptick, reflecting a robust performance amidst broader market fluctuations. In the last quarter, the index has reported a rise of approximately 12%, indicating strong investor confidence and institutional buying in the small-cap segment. Factors contributing to this positive trend include the revival of economic activities post-pandemic, government initiatives supporting small businesses, and increased foreign investments.

Key Factors Driving Growth

Several elements have contributed to the upward momentum of small-cap stocks on the BSE:

- Economic Recovery: The Indian economy’s recovery from the pandemic has enabled small-cap companies to rebound strongly, as they are typically more agile in adapting to market changes.

- Government Initiatives: Recent policy measures and financial support aimed at enhancing MSME growth have significantly boosted small-cap stocks. Schemes like the EMERGE platform have facilitated quicker access to capital for smaller firms.

- Investor Sentiment: Retail investors have shifted their focus towards small-cap stocks, attracted by their potential for high returns compared to large-cap stocks which have seen slower growth.

Conclusion

The ongoing performance of the BSE Small Cap index underscores the opportunities available in the small-cap segment of the market. Investors are encouraged to stay informed about trends and consider leveraging the potential benefits while being mindful of the inherent risks associated with smaller stocks. With the economy gradually stabilizing and new ventures emerging, the small-cap arena is poised for continued growth, making it a significant segment for investors looking to diversify their portfolios. As we progress into 2024, market watchers will keenly observe how these stocks hold up and adapt to changing economic conditions, setting a promising stage for aspiring small-cap investors.