Understanding BSE Share Price Trends and Market Insights

Introduction: Importance of BSE Share Price

The Bombay Stock Exchange (BSE) is one of the oldest and most prominent stock exchanges in India, playing a crucial role in the nation’s financial markets. The BSE share price serves as a barometer for market sentiments and economic health, influencing both investor decisions and corporate strategies. As fluctuations in share prices occur due to various factors including economic indicators, corporate announcements, and global trends, understanding these prices is essential for investors looking to make informed decisions.

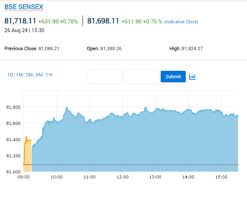

Current Trends in BSE Share Price

As of October 2023, the BSE Share Price Index sees significant fluctuations influenced by macroeconomic factors. Recent data indicates that the BSE Sensex has experienced a rise of approximately 6% over the past quarter. This bullish trend is attributed to robust corporate earnings, coupled with favorable government policies aimed at stimulating growth.

Sector-wise performance shows that the IT and pharma sectors have outperformed others, largely due to increasing domestic demand and positive global cues. Notable stocks such as TCS and Infosys have seen share price increases, contributing positively to the overall Sensex rally.

Factors Influencing BSE Share Prices

Multiple elements contribute to the movement of share prices on the BSE. Key factors include:

- Global Markets: International market trends often dictate local pricing, with factors like foreign portfolio investments playing a significant role.

- Economic Indicators: Data such as GDP growth, inflation rates, and employment statistics provide insight into the economic climate, influencing investor confidence.

- Corporate Earnings: Quarterly earnings reports can lead to drastic shifts in share prices, as they provide a clear picture of company performance.

- Regulatory Changes: Government policies and initiatives can either bolster or restrict share prices based on their perceived impact on various sectors.

Conclusion: Future Outlook for Investors

Looking ahead, the BSE share price is expected to continue experiencing volatility, driven by ongoing economic recovery initiatives and global market dynamics. Investors are advised to stay informed about economic indicators and sector-specific news to optimize their investment strategies. The current trend of rising prices in certain sectors may represent lucrative opportunities, but caution is encouraged due to potential market corrections.

In conclusion, understanding BSE share prices and their influencing factors will be essential for both new and seasoned investors as they navigate the complexities of the Indian stock market.