Understanding Broadcom Share Price Trends

Introduction

The share price of Broadcom Inc., a leading global technology company, is of significant interest to investors and market analysts. As a key player in the semiconductor industry, Broadcom’s performance can influence market trends and investor sentiment due to its diverse product portfolio that serves various sectors, including wireless communication, data center, and broadband.

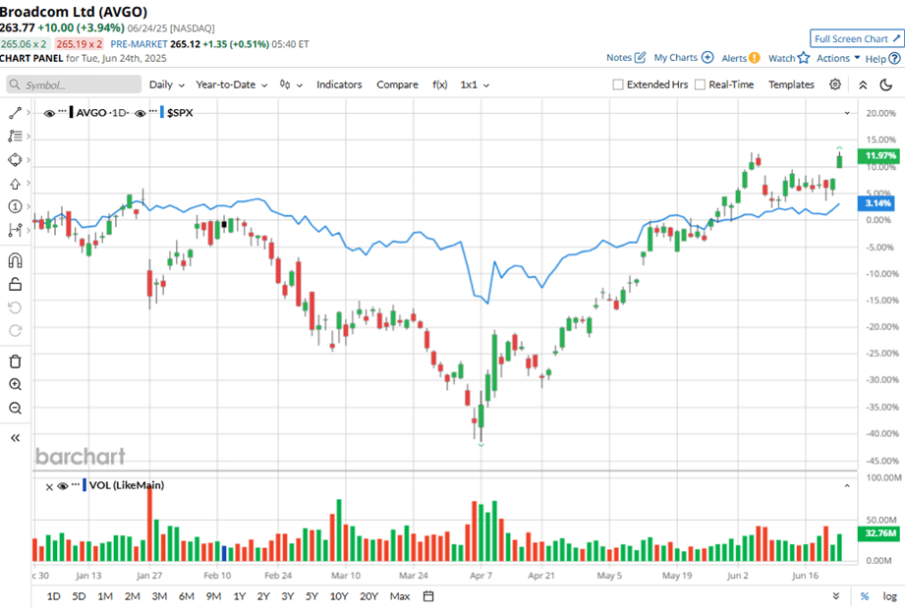

Current Share Price Trends

As of October 2023, the share price of Broadcom has been experiencing fluctuations due to various market dynamics. Recent reports indicate that the share price has seen a slight increase, closing at approximately $600, reflecting a stronger demand for its components and favorable quarterly results. Analysts attributed this increase to robust sales in the data center segment and successful deployments in 5G technologies.

Factors Influencing Broadcom’s Share Price

Several factors play a crucial role in influencing Broadcom’s share price, including:

- Market Demand: The growing demand for smartphones and other connected devices continues to propel sales of semiconductors, benefitting Broadcom.

- Supply Chain Dynamics: The global chip shortage has had a mixed effect; while it has increased prices due to high demand, it has also caused supply chain constraints.

- Technological Advancements: Innovations in 5G and AI technology are leading to increased investments in semiconductor production, which may drive further growth for Broadcom.

Analyst Predictions

Market analysts remain optimistic about Broadcom’s growth trajectory. Many expect that the share price could rise further in the coming months, with estimates suggesting it could reach between $620 and $650 by the end of the year, assuming stable market conditions and continued demand for their products.

Conclusion

Monitoring Broadcom’s share price offers critical insights into the technology sector and broader market trends. Investors should consider numerous factors, including market demand and supply chain issues, when evaluating their strategies surrounding Broadcom shares. As the company continues to expand its offerings in emerging technologies, its share price will likely reflect its performance and adaptability in a rapidly changing industry.