Understanding BEML Share Price Trends in 2023

Introduction

In the ever-evolving world of stock markets, monitoring share prices is pivotal for investors looking to make informed decisions. BEML Limited, a key player in the manufacturing of defense, mining, and construction equipment, has garnered significant attention in recent months. With its growth trajectory and strategic initiatives, understanding the BEML share price is crucial for both current and prospective shareholders.

Current Trends in BEML Share Price

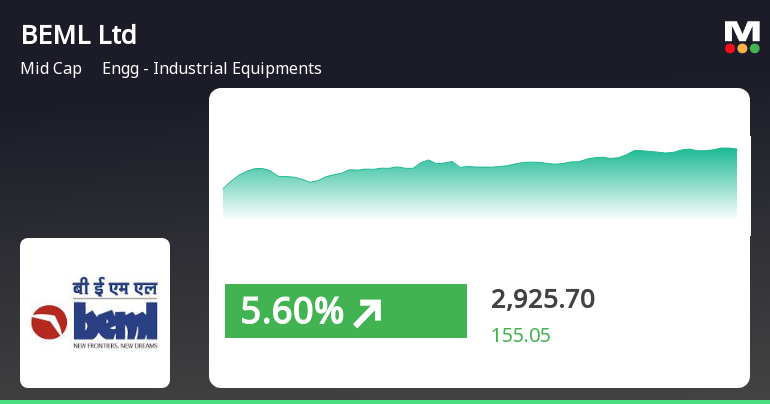

As of October 2023, the BEML share price has shown notable fluctuations, reflecting broader market trends and sector-specific developments. The share, which trades on the National Stock Exchange (NSE) under the symbol BEML, has witnessed changes in investor sentiment driven by government policies, infrastructure development projects, and defense procurement programs.

In recent weeks, BEML’s share price has seen a rise of approximately 15% following the announcement of increased spending in defense and infrastructure by the Indian government. Analysts have pointed out that such measures create a favorable environment for companies like BEML, which stand to benefit directly from increased orders for heavy machinery and defense equipment.

Factors Influencing BEML Share Price

Several factors influence the share price of BEML. Firstly, the company’s performance in quarterly earnings reports significantly sways investor confidence. For instance, the latest quarterly earnings report revealed a 12% increase in revenue compared to the previous year, bolstered by strong demand in both the mining and defense sectors.

Secondly, macroeconomic indicators such as GDP growth, foreign investment inflows, and global commodity prices play a crucial role. An increase in coal, iron ore, and other minerals prices often results in increased mining activity, benefiting companies like BEML.

Future Outlook

Market analysts have mixed projections for BEML’s share price moving forward. While some predict continued growth based on current contracts and government support for infrastructure, others warn of potential volatility. Geopolitical tensions and global market fluctuations might influence demand for defense equipment, thereby impacting BEML’s performance.

In summary, monitoring BEML’s share price is essential for investors aiming to understand market dynamics within the manufacturing and defense sectors. With ongoing government initiatives and economic recovery post-pandemic, BEML could offer lucrative opportunities, though potential investors should remain vigilant of market conditions and global developments.

Conclusion

As BEML continues to adapt to changing market conditions and operational capabilities, its share price will likely remain a topic of interest among investors. By analyzing trends and understanding the underlying factors, stakeholders can better position themselves in this dynamic market.