Understanding BEML Share Price Movements and Trends

Introduction to BEML and Its Market Position

As a prominent player in the manufacturing of heavy equipment, BEML Limited holds a significant position in the Indian market. Listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), BEML has been attracting investor interest due to its consistent growth and strategic initiatives. Understanding the trends in BEML’s share price is crucial for both current and potential investors, particularly in the context of India’s expanding infrastructure sector.

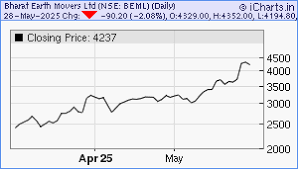

Recent Trends in BEML Share Price

As of late October 2023, BEML shares have shown considerable volatility, reflecting both global economic conditions and specific company performance metrics. After a dip in Q2 of 2023 attributed to inflation and supply chain challenges, the share price has rebounded, closing around INR 1,800, marking a gain of approximately 12% over the past month. Analyst forecasts indicate that this upward trend might continue due to increased government spending on infrastructure projects, especially in railways and defense sectors where BEML is heavily involved.

Factors Influencing Share Price

Several key factors are influencing BEML’s share price:

- Government Contracts: Recent contracts awarded for railway projects and military vehicles have positively impacted investor sentiment.

- Market Dynamics: The overall growth in the capital goods sector in India indicates a robust demand for heavy machinery, which BEML is equipped to supply.

- Financial Performance: The company recently reported a 15% increase in revenue year-over-year, strengthening its financial outlook.

Investment Outlook and Analyst Recommendations

Market analysts remain optimistic about BEML’s long-term prospects, with many recommending a “buy” rating based on current valuations and future earnings potential. Factors such as diversification of product lines and expansion into new markets are seen as positive signs for future growth. However, potential investors should be cautious, as fluctuations in global markets and raw material costs could pose risks.

Conclusion: Preparing for the Future with BEML

In conclusion, BEML’s share price offers a fascinating insight into the broader economic landscape and the performance of the infrastructure sector in India. As the company navigates through the current market conditions and capitalizes on new opportunities, investors should stay informed on developments. Following BEML’s progress and understanding its market strategies can equip investors with the necessary insights to make informed decisions. The outlook for BEML remains positive, but vigilance regarding market conditions is advised.