Understanding BEL Share: Trends and Future Insights

Introduction

The shares of Bharat Electronics Limited (BEL) have been in the spotlight recently due to their pivotal role in India’s defense sector and technology advancements. As a public sector enterprise, BEL has consistently contributed to the country’s indigenous defense production capabilities, making its shares an attractive investment option for many. The relevance of well-informed decisions regarding BEL shares cannot be overstated, especially in light of the ongoing economic developments and government initiatives aimed at boosting defense manufacturing.

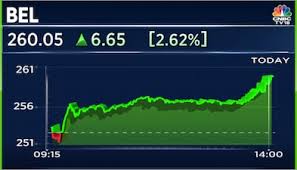

Current Market Performance

As of the latest trading sessions, BEL shares have exhibited a noteworthy upward trend, reflecting positive investor sentiment. The stock has reported a price increase of approximately 15% over the past month, driven by several factors including robust quarterly earnings that surpassed analysts’ expectations. In the second quarter of the fiscal year, BEL reported a significant increase in profit, bolstered by new contracts in defense and aerospace sectors.

Key Drivers Behind the Upward Trend

One of the primary drivers of BEL’s stock performance is the Indian government’s increased focus on self-reliance in defense production. Initiatives like “Aatmanirbhar Bharat” have led to higher capital allocations towards defense sectors, directly benefiting companies like BEL. Moreover, the anticipation of upcoming projects related to drone technology and missile systems has further fueled positive market responses.

Global Economic Factors

Additionally, the global defense spending trends are on the rise. Countries around the world are reallocating budgets towards enhancing security and defense measures, indirectly benefiting companies like BEL that are involved in defense electronics and systems. This international landscape poses significant opportunities for BEL to expand its market share and product offerings.

Conclusion

In summary, BEL shares are currently experiencing a promising trajectory fueled by strong government support, increasing market demand for defense technologies, and overall positive investor sentiment. While past performance is a key indicator, potential investors should remain vigilant of market changes and governmental policies that may impact BEL’s future growth. Therefore, the outlook for BEL shares remains optimistic, reinforcing the importance of continued engagement with this company for both seasoned investors and newcomers alike.