Understanding BBMP Property Tax in Bengaluru

Introduction

The BBMP (Bruhat Bengaluru Mahanagara Palike) property tax is a crucial aspect for property owners in Bengaluru, ensuring necessary civic amenities and infrastructure development across the city. With Bengaluru’s rapid urbanization, understanding the property tax implications has become increasingly important for both residents and investors in the real estate sector.

Current Status of BBMP Property Tax

As of 2023, BBMP has made significant updates to its property tax system to streamline processes and encourage timely payments. According to recent reports, the revenue generated from property taxes plays a pivotal role in funding various development projects in the city, such as road maintenance, waste management, and enhancing public spaces.

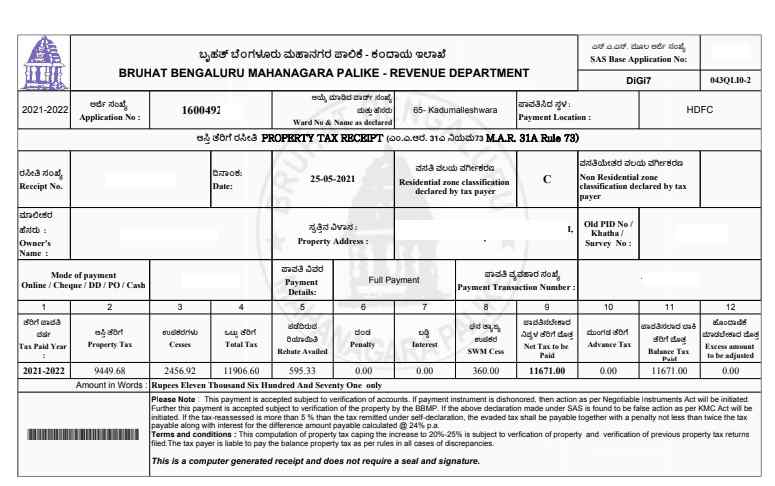

BBMP has been emphasizing digitalization to simplify the payment process. The online portal allows property owners to check tax dues and make payments conveniently, reducing the need for physical visits to BBMP offices. Furthermore, BBMP has also introduced measures to ensure compliance with property tax regulations by addressing under-assessment and tax evasion effectively.

Recent Developments

In recent months, there have been discussions regarding potential hikes in property tax rates. The BBMP is in the process of reassessing property values to align them more closely with the current market rates. This exercise is essential for ensuring that the tax burden is distributed fairly among property owners. The council has indicated that rates could rise by 15% to 20%, causing concerns among residents who are already facing high living costs.

Moreover, the BBMP has launched awareness campaigns to educate citizens about the importance of timely payments. Delays can result in penalties and increased financial liabilities, underscoring the need for property owners to stay informed and comply with regulations.

Conclusion

As Bengaluru continues to grow, the BBMP property tax remains a critical component of its urban planning and infrastructure funding. Property owners should closely monitor changes and developments related to property tax to avoid unexpected financial burdens. Understanding the tax landscape not only helps in compliance but also plays a vital role in contributing to the city’s growth and sustainability. As property valuations are reassessed in the coming months, owners must prepare for possible increases while continuing to advocate for transparency in how tax revenues are utilized for public benefit.