Understanding AMD Share Price Trends in 2023

Introduction

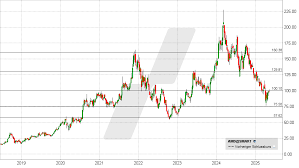

The share price of Advanced Micro Devices (AMD) is a significant indicator of the company’s performance and the overall health of the semiconductor industry. With the continued rise of technology and demand for advanced computing solutions, monitoring AMD’s stock price has never been more crucial for investors and industry analysts alike.

Current Performance and Market Analysis

As of October 2023, AMD’s share price is notably fluctuating amid a volatile tech market. Currently trading around $100 per share, analysts speculate that several key factors are influencing this valuation. AMD’s recent earnings report showcased a revenue increase of 15% year-over-year, primarily driven by strong sales in gaming and data center segments. Despite a slump in PC sales that has affected the entire industry, AMD’s diversification into cloud computing and AI technologies continues to bolster investor confidence.

Recent Developments

One significant development affecting AMD’s share price is the company’s announcement regarding new product releases. The launch of the Ryzen 7000 series processors and EPYC Genoa server chips has garnered positive reviews, promising to enhance AMD’s competitive edge against rivals like Intel and NVIDIA. Furthermore, AMD’s collaboration with key players in AI research has positioned it favorably in the rapidly expanding artificial intelligence market. These advancements lead many analysts to maintain a bullish outlook on AMD shares.

Market Sentiment and Analyst Predictions

Investor sentiment around AMD remains cautiously optimistic. Institutional investors, including large hedge funds, have recently increased their stakes in AMD, indicating a long-term belief in the company’s growth trajectory. Analysts provide varying price targets reflecting market conditions, with estimates ranging from $90 to $120 in the next six to 12 months, depending on the overall performance of the tech sector and macroeconomic factors such as inflation and interest rates.

Conclusion

In conclusion, AMD’s share price is reflective of its robust development in high-demand sectors despite external challenges. With innovative products and strategic directions in emerging markets like artificial intelligence, AMD is well-positioned for future growth. Investors should keep a close eye on AMD’s upcoming earnings reports, market expansions, and global economic conditions which may impact its stock price. The semiconductor industry remains dynamic, and AMD’s adaptability will be critical in sustaining its market performance.