Understanding AMD Share Price: Trends and Analysis

Introduction

As one of the leading brands in the semiconductor industry, Advanced Micro Devices (AMD) plays a significant role in shaping the tech landscape. Its share price is closely monitored by investors and market analysts alike due to the company’s influence in computing and graphics solutions. Recent developments in the tech sector, including the rising demand for next-gen gaming and AI capabilities, have put a spotlight on AMD’s stock performance.

Current Share Price Performance

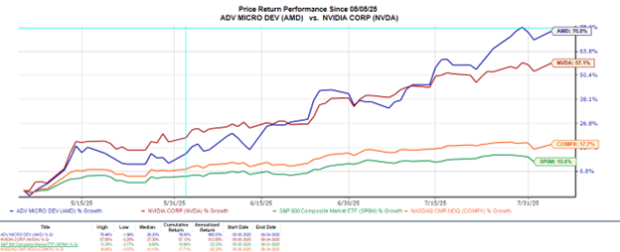

AMD’s share price has seen significant fluctuations in recent months. As of October 2023, AMD shares are trading at approximately $90, showing an increase of about 15% over the past quarter. Analysts attribute this rise to the strong demand for data center processors and GPU sales tied to AI applications. Furthermore, AMD’s recent partnership announcements with major tech firms have also fueled investor optimism.

Market Influences

Several factors influence AMD’s stock performance. Firstly, competitive pressure from rivals like Intel and NVIDIA keeps the market active, as each company strives to innovate and capture market share. Additionally, the semiconductor supply chain recovery post-pandemic has led to increasing sales figures. Moreover, broader economic conditions, such as inflation rates and interest rates, also affect investor confidence in technology stocks.

Future Forecasts

Looking ahead, many analysts expect AMD’s share price to continue its upward trajectory, driven by its strategic focus on innovation and expansion into new markets. The anticipated launch of AMD’s latest product lines is expected to bolster revenue further. However, market volatility and geopolitical tensions, especially concerning semiconductor supply chains, pose risks that investors should be mindful of.

Conclusion

In conclusion, AMD’s share price remains a focal point for investors looking for opportunities within the booming tech sector. As the company continues to innovate and adapt to market demands, its stock performance will likely reflect its operational success. Investors should stay informed about AMD’s developments and broader market trends to make educated decisions regarding their investments.