Understanding AMD Share Price Movements in 2023

Introduction

The share price of Advanced Micro Devices (AMD) is critical to investors, reflecting the company’s performance, market trends, and overall economic conditions. With the semiconductor industry continuously evolving, tracking AMD’s stock becomes essential for understanding the technology market and investment opportunities.

Current Performance and Factors Influencing AMD’s Stock

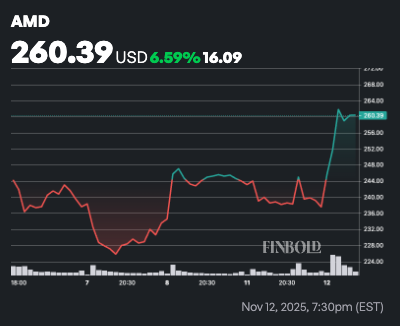

As of October 2023, AMD’s share price has been experiencing significant fluctuations, largely attributed to various factors such as market demand for microprocessors, competition with Intel and Nvidia, and the broader economic landscape. The stock has seen a growth rate of approximately 25% in the past year, showing resilience and adaptability in a challenging market environment.

Despite the global chip shortage, AMD has managed to capture substantial market share, particularly in gaming and data center solutions. Recent reports indicate a surge in demand for AMD’s Ryzen processors amid the rising popularity of gaming PCs and laptops, which significantly contributes to its revenue.

Analyst ratings have also influenced AMD’s stock price. Recently, several investment firms upgraded their forecasts for AMD due to its strategic partnerships and innovative product launches, which have further bolstered investor confidence. As a result, AMD’s share price reached an all-time high of $130 per share earlier this year, demonstrating market enthusiasm.

Outlook and Investment Considerations

Looking forward, several factors will play a crucial role in determining AMD’s share price trajectory. The upcoming product releases, including advanced microchips and potential expansions into new markets, are expected to drive future growth. Additionally, the dynamic landscape of semiconductor supply and demand will also significantly reflect in the stock price.

However, investors should remain cautious. Risks such as increased competition, global supply chain disruptions, and economic uncertainties could negatively impact AMD’s performance. Analysts are divided on whether AMD can sustain its current momentum, with some forecasting potential corrections in its share price in the coming months.

Conclusion

The AMD share price is not just a number; it encapsulates the company’s growth story and its potential in the tech industry. Investors should keep an eye on both short-term fluctuations and long-term prospects as they navigate through AMD’s stock. Understanding the underlying factors, such as market demands and competitive pressures, will prove invaluable for anyone looking to invest in or follow AMD in the ever-evolving tech landscape.