TTML Share Price: Latest Updates and Market Analysis

Introduction

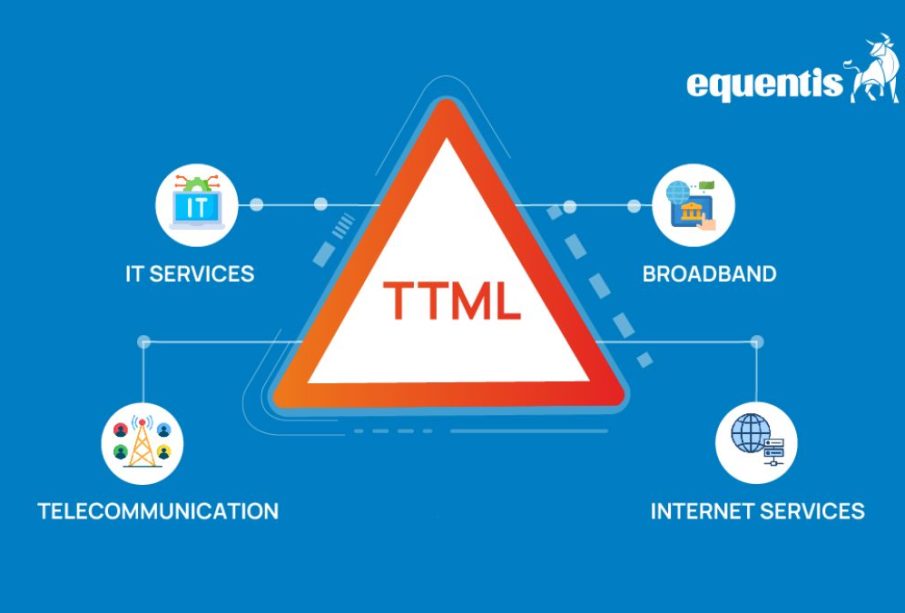

The share price of Tata Teleservices (Maharashtra) Ltd, commonly known as TTML, holds significant importance for investors and market analysts alike. TTML is a major player in the telecom sector, and its financial health can reflect broader industry trends. As the telecommunications sector in India continues to evolve, understanding the fluctuations in the share price of TTML becomes essential for making informed investment decisions.

Current Market Performance

As of the latest trading session, the TTML share price has witnessed notable volatility, closing at ₹105.50, which reflects a slight decrease of 2% from the previous day. Analysts attribute this fluctuation to various factors including investor sentiment, overall market conditions, and operational performance updates from the company.

Recent reports show that TTML has been focusing on expanding its fiber optic network to enhance broadband services, aiming to cater to the increasing demand for high-speed internet. This initiative is expected to contribute positively to the company’s future revenues.

Historical Performance and Trends

Over the last year, TTML’s share price has shown a remarkable upward trend, from around ₹70 to its current levels, demonstrating significant growth prospects attributed to the company’s strategic initiatives and infrastructure expansions. This upward trajectory has been influenced by the increasing digital transformation in India and the rising demand for telecommunications services post-pandemic.

Analyst Recommendations

Market experts remain divided on their outlook for TTML. While some analysts encourage a buy rating, highlighting the company’s potential in the telecom space and its ongoing projects, others exhibit caution due to the competitive nature of the industry and the financial performance nuances. Investors are advised to keep an eye on upcoming quarterly results which may provide further insights into the company’s operational efficiency and market standing.

Conclusion

In conclusion, the TTML share price is a crucial indicator of the company’s market health and potential for growth as the telecom sector continues to adapt to user demands and technological advances. For investors and market watchers, staying updated on TTML’s performance is essential, particularly in light of upcoming strategic announcements and financial reports. As always, investing in the stock market entails risks, and potential investors should carry out thorough research or consult financial advisors before making investment decisions.