TTML Share Price: Current Trends and Market Analysis

Introduction

The share price of Tata Teleservices (Maharashtra) Limited (TTML) has become a focal point for investors in the telecommunications sector. As the industry grapples with increasing competition and regulatory changes, understanding the fluctuations in TTML’s share price is essential for making informed investment decisions. This article provides an overview of recent trends in TTML’s share price and the factors influencing it.

Recent Developments

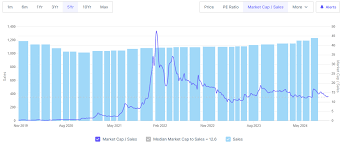

As of October 25, 2023, TTML stocks have shown significant volatility, reflecting broader market trends and specific company developments. The share price recently experienced a surge, reaching INR 38.50, which represents a 10% increase from the previous week. Analysts attribute this rise to positive quarterly earnings reports and an uptick in new subscribers, signaling growing market confidence.

Moreover, the company announced plans to expand its 5G offerings, which have generated optimism among investors. The global shift towards more advanced telecommunication infrastructure has instigated a renewed focus on Tata Teleservices’ strategic initiatives. With the Indian government’s push for digitalization, TTML is positioning itself to capitalize on emerging opportunities.

Market Analysis

Experts note that although the recent price surge is encouraging, TTML must contend with significant challenges. The fierce rivalry with established players in the telecom sector like Reliance Jio and Bharti Airtel requires continual innovation and investment. The company’s debt levels, which have posed challenges in the past, remain a point of concern for investors evaluating long-term viability.

Additionally, analysts predict that the share price may continue to fluctuate as the market reacts to various economic indicators including inflation rates and consumer spending patterns. Factors such as regulatory changes in the telecom industry and shifts in consumer behavior will be closely monitored for their potential impact on TTML’s market standing.

Conclusion

TTML’s recent performance reflects a dynamic intersection of opportunity and risk within the telecommunications space. Investors should remain vigilant, observing both company-specific developments and broader industry trends. The current price of INR 38.50 provides a snapshot of TTML’s ongoing evolution but underscores the need for strategic foresight in this competitive landscape. As the company makes strides in technology and service improvements, its share price trajectory will be pivotal for stakeholders looking at future prospects. Keeping abreast of earnings reports and market news will be critical for those looking to invest in TTML shares.