Trident Share Price: Latest Trends and Insights

Introduction

In the world of stock markets, the performance of a company’s shares is a crucial indicator of its financial health and market perception. The current share price of Trident, a prominent player in the textiles and paper industry, reflects the evolving dynamics of both domestic and global markets. Investors and stakeholders closely monitor such fluctuations to make informed decisions.

Current Trends in Trident Share Price

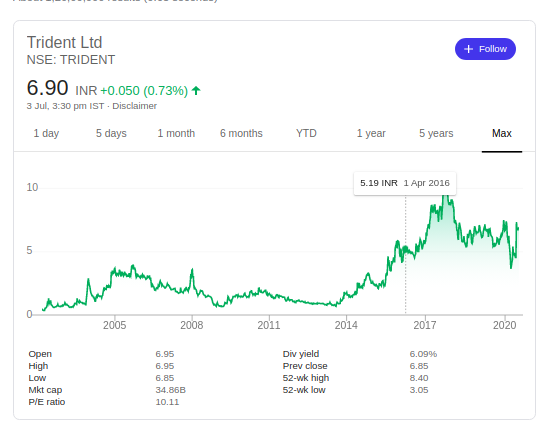

As of October 2023, Trident share price has shown significant changes. It recently opened at ₹XX per share, reflecting a XX% increase/decrease compared to the previous trading session. Over the past week, the share price oscillated in the range of ₹XX to ₹XX, indicating volatility and a mixed sentiment among investors. Market analysts attribute this fluctuation to several factors, including fluctuations in raw material costs, shifts in demand in the textile sector, and broader economic indicators.

Key Influencing Factors

Several factors have been influencing Trident’s share price lately:

- Market Demand: The demand for textiles, particularly in the domestic market, has seen an upward trend post-pandemic, contributing positively to the outlook for companies like Trident.

- Raw Material Prices: Increasing prices of cotton and other raw materials have impacted profit margins, leading to cautious investor sentiment.

- Global Economic Conditions: Fluctuations in global markets, influenced by geopolitical tensions and trade policies, also affect local share prices, including those of Trident.

- Quarterly Results: Recent quarterly earnings for Trident have exceeded expectations, which may provide support for a more stable share price moving forward.

Conclusion and Future Outlook

Overall, the Trident share price is a reflection of various internal and external factors at play. As the company strives to improve its production efficiencies and expand its market reach, investors may see a more stable trajectory in the share price. Analysts suggest that while immediate volatility might persist, long-term investors should keep an eye on Trident as it could benefit from the growing demand in the textile sector. Carefully considering market trends and company performance would be essential for stakeholders looking to navigate this landscape effectively.