Tesla Share Price: Recent Trends and Future Forecasts

Introduction

Tesla, Inc., the leading electric vehicle manufacturer founded by Elon Musk, has seen its share price gain significant attention in recent years. The importance of tracking the Tesla share price lies in understanding its impact on both investors and the broader electric vehicle market. As a key player in sustainable technology, fluctuations in Tesla’s stock can influence investment choices, market confidence, and even governmental policies toward green initiatives.

Current Trends

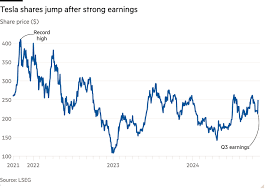

As of October 2023, Tesla’s share price has experienced notable volatility influenced by various factors. The stock recently traded at approximately ₹21,000 (around $250), reflecting a year-to-date increase of roughly 38%. This rise can be attributed to several factors, including increased production capacity, positive quarterly earnings reports, and growing demand for electric vehicles in global markets.

Moreover, Tesla’s expansion into international markets, particularly in Europe and Asia, has bolstered investor sentiment. The company’s strategic move to build new Gigafactories and enhance supply chains has also been a pivotal factor leading to stock price appreciation. Recent reports show that Tesla’s Model 3 and Model Y have become top sellers in many regions, affirming the company’s dominant position in the industry.

Market Sentiment

Analysts continue to have a bullish outlook on Tesla, citing its potential for long-term growth amidst rising competition in the EV sector. However, some experts caution that the stock may be overvalued. Factors such as rising interest rates, inflationary pressures, and potential regulatory challenges could pose risks to the company’s financial performance and, by extension, its share price.

Future Forecasts

Looking ahead, Tesla is expected to navigate numerous challenges, including supply chain disruptions and increased competition from other electric vehicle manufacturers. Nonetheless, projections for Tesla’s share price remain optimistic, with analysts predicting it could reach ₹25,000 ($300) in the next 12 months, driven by new product launches and advancements in battery technology.

Conclusion

The Tesla share price remains a critical metric for both investors and market analysts. As the company continues to evolve and adapt within a competitive landscape, understanding its stock movements is essential for making informed investment decisions. With significant developments on the horizon, the future of Tesla’s share price will be closely monitored as an indicator of broader trends in the automotive and technology markets.