Tesla Share Price: Current Trends and Insights

Introduction

The share price of Tesla Inc. has become a hot topic among investors and analysts due to its volatility and impact on the electric vehicle market. As one of the leading players in the automotive industry, Tesla’s stock performance is not only a reflection of its business health but also a significant indicator of broader trends in technology and renewable energy sectors. In recent months, fluctuations in Tesla’s share price have drawn attention, making it imperative for stakeholders to analyze the underlying factors driving these changes.

Current Trends in Tesla Share Price

As of October 2023, Tesla’s share price is experiencing fluctuations that have seen it hover around $250 per share, down from its high of around $307 earlier this year. This decline can be attributed to several factors including supply chain disruptions, increasing competition in the electric vehicle market, and fluctuating investor sentiment. Reports from industry analysts suggest that the company’s efforts to ramp up production, especially with the launch of the much-anticipated Cybertruck, could impact future stock performance significantly.

Factors Influencing Tesla’s Recent Share Price Movement

1. Production and Deliveries

In recent financial reports, Tesla indicated challenges in meeting production targets due to ongoing supply chain issues, particularly chips essential for their vehicles. This has led to a decline in delivery numbers, raising concerns among investors about the company’s growth trajectory.

2. Market Competition

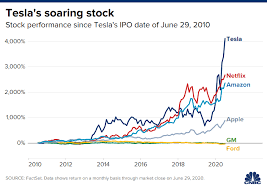

Another critical factor is the increasing competition in the electric vehicle segment. Major automakers like Ford, GM, and newly revamped competitors from China are entering the market with their EV offerings, putting pressure on Tesla to innovate and maintain market share.

3. Investor Sentiment and Economic Trends

Tesla’s stock is also susceptible to overall market trends and macroeconomic factors. As inflation rates persist and interest rates rise, investors are reassessing their portfolios, leading to potential sell-offs in high-growth stocks such as Tesla. Market analysts suggest that as economic conditions stabilize, investor confidence may return.

Conclusion

The share price of Tesla remains a focal point for investors looking to capitalize on the volatile stock market. With the company poised to introduce new models and improve production efficiency, there are both risks and opportunities for stakeholders. As Tesla continues to navigate through competitive pressures and economic uncertainties, the future trajectory of its share price will depend significantly on its ability to deliver on promises and meet market expectations. Investors and analysts alike will need to keep a close eye on Tesla’s upcoming quarterly earnings and production forecasts to make informed decisions moving forward.