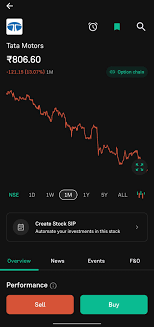

Tata Motors Share Price: Current Trends and Analysis

Introduction

In the dynamic world of stock trading, the performance of major companies like Tata Motors holds significant implications for investors and market analysts alike. The share price of Tata Motors, a leading player in the Indian automotive industry, reflects not only the company’s operational efficiency but also broader market trends and consumer sentiments. As we move through 2023, understanding the fluctuations and trends in Tata Motors share price becomes crucial for potential investors and stakeholders.

Recent Price Trends

As of October 2023, Tata Motors shares have shown notable fluctuations influenced by various factors including raw material costs, changes in consumer demand, and global economic conditions. The stock price recently hovered around ₹650 per share, a rise from earlier in the year where it faced significant pressure due to supply chain constraints and inflationary pressures commonly affecting the automotive sector.

Factors Impacting Share Price

Several key events and factors have impacted the Tata Motors share price in recent months:

- Quarterly Earnings Reports: The latest quarterly report indicated a recovery in profit margins, which positively influenced investor sentiment.

- Electric Vehicle (EV) Market Growth: Tata Motors has been heavily investing in electric vehicle technology, and its moves to expand its EV portfolio have been well-received. The anticipated launch of new models has helped boost confidence among investors.

- Global Supply Chain Trends: With global suppliers stabilizing after disruptions, Tata Motors appears better positioned to meet demand without significant delays.

Market Analysts’ Outlook

Market analysts remain cautiously optimistic about Tata Motors’ future share price trajectory. According to a recent analysis by leading financial houses, Tata Motors is well-positioned to capitalize on emerging trends in the EV sector. Predictions suggest that if current trends hold, the share price could reach between ₹700-₹750 in the coming months, provided that the inflationary pressures stabilize and consumer confidence returns fully.

Conclusion

In summary, Tata Motors share price is influenced by a complex interplay of operational performance and external market conditions. For investors, staying informed about the company’s strategic moves, particularly in the EV sector, is vital for making educated decisions. As Tata Motors continues to innovate and respond to market challenges, its share price trajectory remains a focal point of interest for both seasoned investors and market newcomers.