Tata Motors Q4 Results Preview: Expectations and Insights

Introduction

Tata Motors, one of India’s largest automobile manufacturers, is set to release its fourth-quarter results for the fiscal year 2022-2023 on May 26, 2023. The performance of Tata Motors is closely watched by investors, analysts, and industry experts due to its significant role in the Indian automotive sector and its ambitious electric vehicle (EV) strategy. Given the increasing competition in the EV market and changes in consumer preferences, the upcoming results will provide critical insights into the company’s financial health and growth trajectory.

Current Market Context

The global automotive industry has faced several challenges, including supply chain disruptions and fluctuating commodity prices. However, Tata Motors has shown resilience, attributed to its diverse product portfolio and strong demand for its commercial vehicles. The company has also been aggressively pushing its electric vehicle range, which includes models like the Tata Nexon EV and Tata Tigor EV, aligning with India’s push towards sustainable mobility.

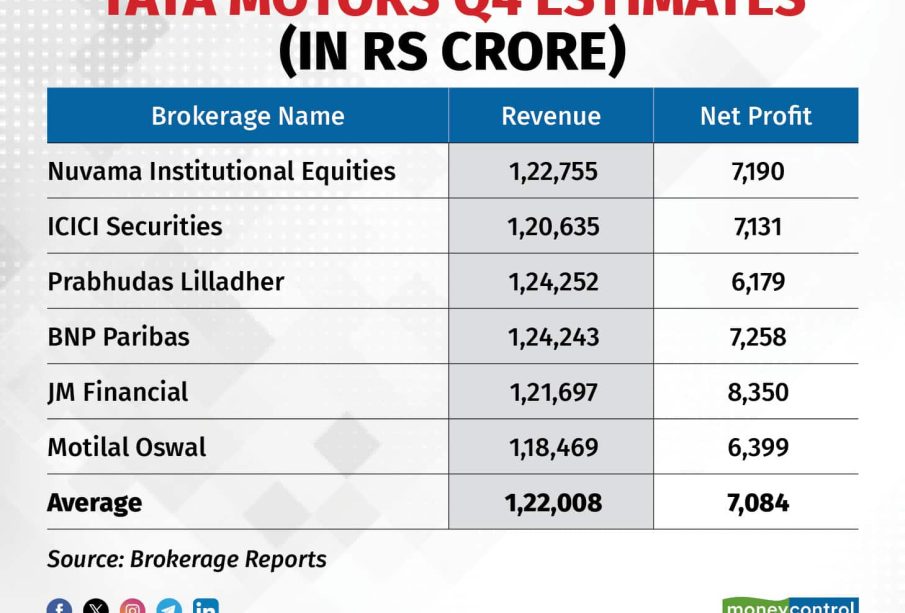

Analysts’ Expectations

Analysts estimate that Tata Motors may report a substantial year-on-year growth in revenue, driven by strong sales across both passenger and commercial vehicle segments. The company’s focus on electric vehicles is expected to be a key theme in the results. Industry experts are predicting that Tata Motors’ revenue for Q4 could reach around INR 85,000 to 90,000 crores, with a net profit margin reflecting improved operational efficiencies.

Moreover, the recent rollout of the new Tata Safari and Tata Harrier models, which have received positive feedback from consumers, is expected to enhance the overall sales figures. Additionally, Tata Motors has been investing heavily in enhancing its production capabilities, particularly for EVs, which is likely to support sales growth going forward.

Potential Challenges

Despite the optimistic outlook, Tata Motors will face challenges such as rising raw material costs and the ongoing semiconductor shortage, which may impact production levels. Analysts will be closely assessing the company’s comments on these challenges during the earnings call.

Conclusion

In summary, Tata Motors’ Q4 results are anticipated to shed light on the company’s ability to navigate a rapidly changing automotive landscape while capitalizing on electric vehicle demand. With increasing consumer focus on sustainability and Tata Motors’ strategic investments in EV technology, the outcomes of this earnings release will have significant implications for investors and stakeholders. As the market evolves, Tata Motors’ performance will be key to understanding broader trends in the automotive industry and the company’s trajectory in the years to come.