S&P 500: Understanding Its Current Performance and Trends

Introduction to S&P 500

The S&P 500, a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States, serves as a key indicator of the overall health of the U.S. economy. As of late 2023, the index has become increasingly pertinent for investors and market analysts, reflecting not only corporate performance but also wider economic trends and shifts.

Current Trends in the S&P 500

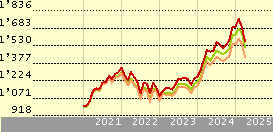

As of November 2023, the S&P 500 has shown resilience amid economic challenges, with year-to-date gains rising by approximately 15%. Several factors have contributed to this positive performance, including strong quarterly earnings reports from major companies and a gradual improvement in consumer spending as inflation levels begin to stabilize. Tech giants like Apple, Microsoft, and Alphabet have been pivotal, driving market sentiment upward with significant earnings.

Moreover, sectors such as energy and financials have also witnessed noteworthy growth, reflecting the ongoing recovery phases post-pandemic and adjustments to supply chain dynamics. Notably, the energy sector has capitalized on geopolitical events affecting oil supply, while financial institutions benefit from rising interest rates, which bolster profit margins.

Market Responses and Economic Indicators

Market analysts have closely monitored the correlation between the S&P 500 and various economic indicators including the unemployment rate, consumer confidence, and inflation metrics. The Federal Reserve’s stance on interest rates remains pivotal, as further rate hikes are anticipated in response to persistent inflation, directly impacting borrowing costs for consumers and businesses alike. As a result, volatility in the index is likely in the coming months, as the market adjusts to these economic signals.

Conclusion: Future Implications for Investors

In conclusion, the S&P 500 stands as a critical barometer for the U.S. economy and investment landscape. Its recent performance underscored by strong corporate earnings and sectoral resilience posits a cautiously optimistic outlook for investors. However, with continued uncertainty regarding inflation and interest rates, maintaining a diversified investment strategy remains crucial. Observing the reactions of the S&P 500 to macroeconomic changes will serve as a guiding light for future investment decisions.