Significance of FII Data in India’s Stock Market

Introduction

Foreign Institutional Investors (FIIs) play a crucial role in the Indian stock market, influencing liquidity and market sentiment. Understanding FII data is essential for investors and analysts to gauge market trends and potential investment opportunities. As India continues to be an attractive destination for foreign investments, the analysis of FII data remains vital for stakeholders.

Current Trends in FII Investments

As of October 2023, recent FII data indicates a significant inflow of foreign capital into the Indian equity markets, which has been buoyed by positive macroeconomic indicators and government reforms. According to the National Securities Depository Limited (NSDL), FIIs have net invested approximately ₹35,000 crore in the Indian stock market over the past month. This marks a recovery phase as FIIs had earlier withdrawn substantial funds during the market volatility caused by geopolitical tensions and global inflationary pressures.

Factors Influencing FII Data

Several factors contribute to the changing patterns of FII investments. Primarily, India’s robust economic growth forecast, estimated at 6.5% in the current fiscal year, has drawn FIIs’ attention. Additionally, India’s attractive valuation metrics compared to other emerging markets coupled with structural reforms aimed at enhancing ease of doing business further add to its appeal. The recent performance of the Indian rupee, which has remained relatively stable against major currencies, also plays a critical role in encouraging foreign investments.

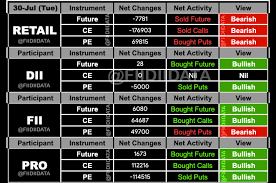

Impact of FII Data on Indian Markets

The influx of FII money tends to enhance overall market liquidity, leading to upward trends in stock prices. It positively influences investor sentiment, which can stimulate domestic investments as well. The S&P BSE Sensex and Nifty 50 indices have seen considerable rallies attributed to FII purchases, demonstrating a direct correlation between FII activities and market performance.

Conclusion

In conclusion, FII data serves as a barometer for market health and confidence amongst international investors. As we move towards the final quarter of the year, it is anticipated that FIIs will continue to monitor India’s economic indicators and political landscape closely, adjusting their investment strategies accordingly. For domestic investors, keeping an eye on FII trends can provide valuable insight into market direction and potential investment opportunities. Understanding the intricate relationship between FII activities and the Indian stock market will be essential for making informed decisions.