Sambhav Steel IPO GMP: Market Insights and Expectations

Introduction

The Sambhav Steel IPO has generated significant buzz in the financial market as investors look forward to its upcoming launch. Initial Public Offerings (IPOs) have gained immense popularity in India, and understanding the Grey Market Premium (GMP) of a new stock provides crucial insights into investor sentiments and market expectations. This article delves into the details surrounding the Sambhav Steel IPO GMP, shedding light on what potential investors should know.

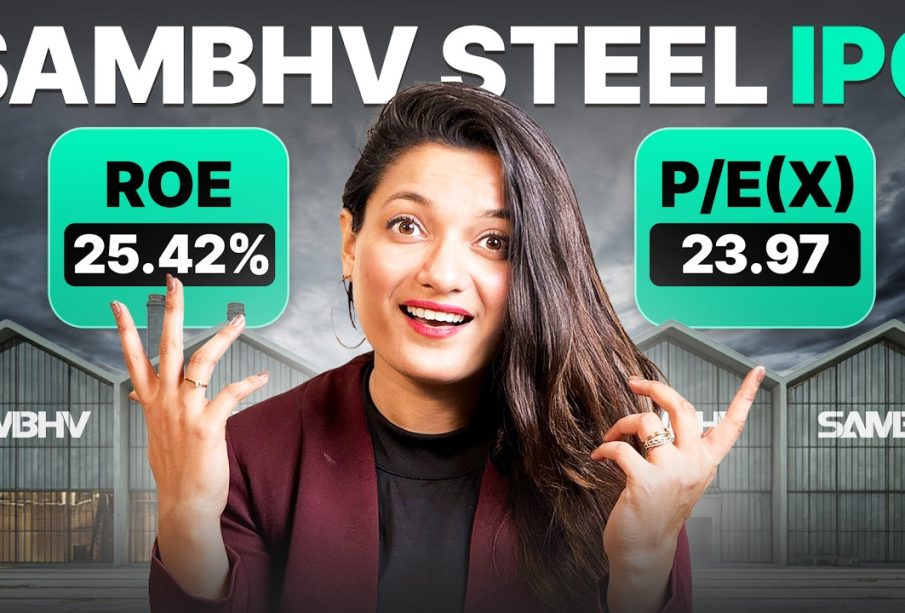

Details about Sambhav Steel IPO

Sambhav Steel, a prominent player in the steel manufacturing sector, is set to raise funds through its IPO aimed at expansions and fulfilling various corporate needs. The company plans to issue a significant number of shares at a certain price band, which is yet to be finalized. The IPO is expected to attract a lot of attention because of the company’s robust growth trajectory and the increase in demand for steel in the country.

Current GMP of Sambhav Steel

As of the latest reports, the Sambhav Steel IPO GMP is showing positive indications, reflecting a healthy demand from the investment community. The current GMP stands at approximately ₹50, suggesting that the stock is expected to list at ₹50 above its issue price, which is a favorable sign for investors. A positive GMP indicates high investor confidence and suggests that shares of Sambhav Steel may see a strong opening on listing day.

Factors Influencing GMP

Several factors are influencing the GMP of Sambhav Steel. The overall market sentiment towards steel companies, the outlook for infrastructure projects, and the macroeconomic environment will play pivotal roles. Additionally, the company’s performance in the pre-IPO subscription and demand from retail and institutional investors are key indicators of how well the stock may perform once listed.

Conclusion

The anticipated Sambhav Steel IPO and its positive GMP underline the growing interest in the steel sector within India’s dynamic economy. Investors should keep a close eye on the developments leading up to the IPO date, including the finalized price band and subscription details. With infrastructure projects on the rise and an expanding market for steel, Sambhav Steel not only aims to strengthen its position but also represents an exciting opportunity for potential investors. As we get closer to the IPO date, staying informed will be crucial for making strategic investment decisions.