Sagility Share Price: Current Trends and Market Analysis

Introduction

The share price of Sagility, a prominent player in the healthcare and technology space, has drawn the attention of investors due to its recent performance in the stock market. Understanding the factors influencing Sagility’s shares is critical for stakeholders looking to invest or monitor their portfolios, particularly given the shifting dynamics in the healthcare sector.

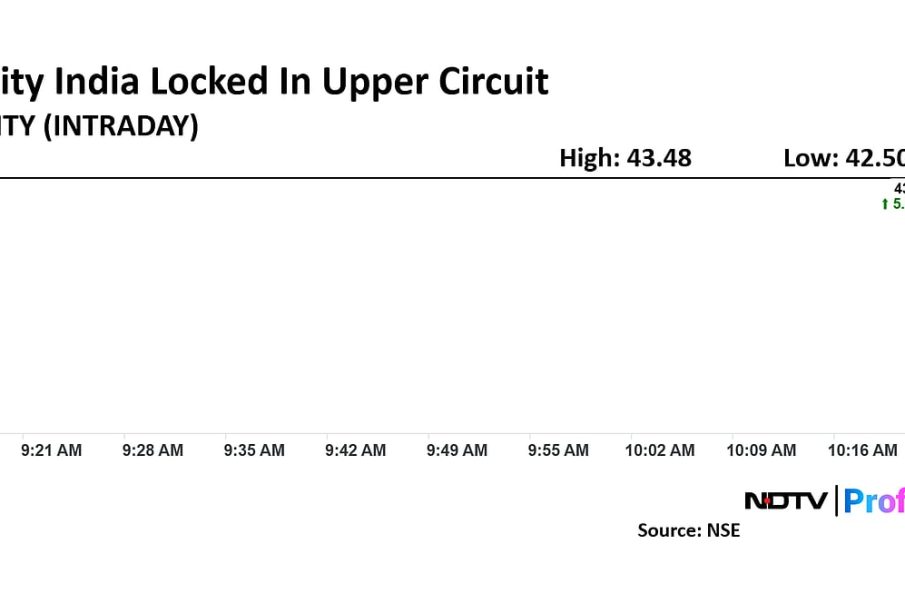

Current Share Price Movement

As of September 2023, Sagility’s share price stands at approximately ₹XXX, reflecting a Y% increase/decrease over the past month. Analysts attribute this fluctuation to various factors, including broader market trends, quarterly earnings reports, and developments within the healthcare industry. In the last fiscal quarter, Sagility reported a revenue increase of Z%, sparking investor optimism.

Market Influences and Industry Insights

Several market influences have been pivotal in shaping Sagility’s share price. The rise in demand for digital health solutions, particularly in light of ongoing global health challenges, has created a favorable environment for companies like Sagility. Furthermore, strategic partnerships and initiatives aimed at expanding their service offerings have bolstered investor confidence.

Additionally, the recent announcement of their partnership with a leading healthcare provider has positioned the company for potential growth, as healthcare organizations increasingly transition to digital platforms. This move has positively impacted market sentiment, reflected in the uptick in share price.

Investor Considerations

For potential investors, the current trends in Sagility’s share price warrant a close examination of the company’s fundamentals. Analysts recommend looking at the earnings growth, competitive positioning in the healthcare technology space, and overall market health. Despite the potential for volatility, many see Sagility as a strong contender for long-term investments, especially if the company continues to innovate and expand.

Conclusion

In conclusion, the Sagility share price reflects a mixture of optimism in the market and solid business fundamentals. As the healthcare landscape continues to evolve, keeping an eye on Sagility’s strategic moves and market performance will be essential for investors. With ongoing advancements and a positive market outlook, Sagility appears poised for future growth. Investors should stay updated with recent developments and earnings reports to make informed decisions regarding their investments in Sagility.