RVNL Share Price: Current Trends and Future Perspectives

Introduction

RVNL, or Rail Vikas Nigam Limited, plays a crucial role in India’s infrastructure development, especially in the rail sector. The performance of RVNL’s share price is significant not only for investors but also for the broader market, hinting at investor confidence in India’s rail infrastructure initiatives. Recent years have seen an uptick in interest surrounding RVNL shares due to government-led projects, making it vital to keep updated on their price movements.

Current Trends and Analysis

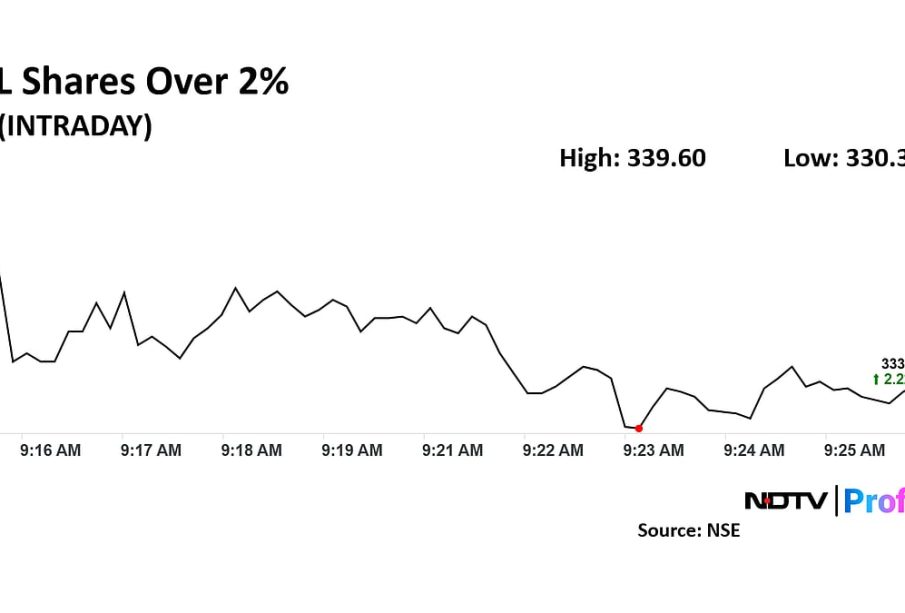

As of October 2023, RVNL shares are trading at INR 38.50, reflecting a modest increase of 2.5% from the previous week. A recent analysis of the company’s quarterly earnings report revealed an increase in revenue by approximately 15% year-on-year, attributed to several new projects initiated under the National Rail Plan. With the government promising more investments in rail infrastructure, the outlook for RVNL remains positive. Furthermore, the company successfully secured several contracts worth over INR 600 million, bolstering its sales potential in the coming quarters.

The company’s share price has experienced volatility; analysts attribute this to fluctuating investor sentiments stemming from broader market changes and specific regulatory developments. Despite these fluctuations, RVNL’s performance appears to be supported by robust fundamentals and strategic government partnerships.

Market Reactions

Investor reactions to RVNL shares have been optimistic in recent months. Analysts from leading brokerages note that the company’s expansion plans, including the development of new railway lines and modernization of existing tracks, provide a strong growth narrative. Moreover, the introduction of green technologies in their projects has attracted attention from sustainable investment funds.

Conclusion

The RVNL share price is indicative of the growing confidence in India’s rail infrastructure. As the government continues to prioritize this sector, RVNL is likely to benefit from increased investments and project approvals. For investors interested in infrastructure stocks, RVNL represents a compelling opportunity. However, fluctuations in share price can occur, so it is advisable to conduct thorough research and consider long-term trends before committing to investments. Overall, with the current trajectory, RVNL may well emerge as a cornerstone in the future of Indian railways.