RVNL Share Price: Current Trends and Future Insights

Introduction

Rail Vikas Nigam Limited (RVNL) has recently gained significant attention in the stock market, particularly in the wake of a series of infrastructure projects initiated by the Government of India. The RVNL share price is an important indicator for investors looking to capitalize on the booming construction and rail sectors in India.

Current Performance

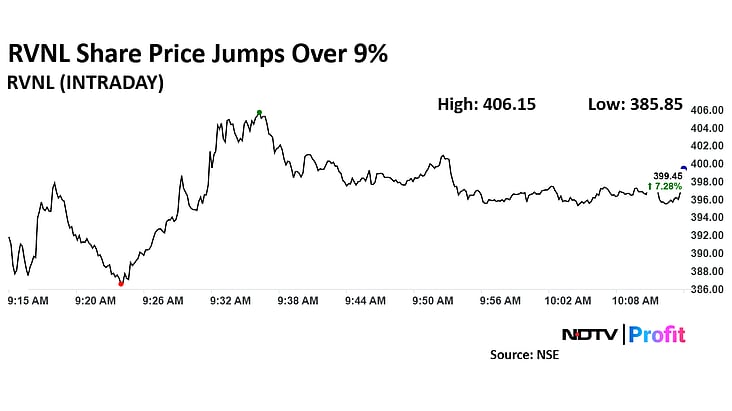

As of the latest trading session on October 15, 2023, RVNL shares are priced at ₹109.50, reflecting a steady increase of 2.30% compared to the previous week. Over the last six months, the stock has shown an upward trend, recovering from earlier lows and gaining approximately 30% in value since April 2023. This growth is attributed to RVNL’s pivotal role in various government projects aimed at enhancing India’s rail and transportation infrastructure.

Factors Influencing RVNL Share Price

The RVNL’s share price is influenced by several factors, including:

- Government Investments: The Indian government’s multiple initiatives for infrastructure development, including the National Infrastructure Pipeline.

- Financial Performance: RVNL’s quarterly results, which have consistently shown revenue growth and improved profit margins.

- Market Sentiment: Investor sentiment towards government stocks and infrastructure plays has remained bullish, supporting RVNL’s share price.

Future Outlook

Market analysts remain optimistic about RVNL’s future prospects. With the government’s continued focus on the railway sector, there is potential for the company to secure additional contracts that could further boost its revenue stream. Additionally, analysts project that RVNL’s share price could reach ₹125 by the first quarter of 2024, driven by strong fundamentals and favorable government policies.

Conclusion

For investors considering RVNL shares, it is crucial to stay informed about market trends and company performance. The rise in RVNL’s share price signifies a robust recovery and the company’s value in the infrastructure growth narrative of India. With encouraging forecasts, RVNL presents a promising investment opportunity for both short-term traders and long-term investors seeking to capitalize on the expanding railway sector.