Recent Trends in Vodafone Idea Share Performance

Introduction

Vodafone Idea Limited (Vi), one of India’s leading telecommunication companies, has been facing significant challenges in the competitive telecom market. The company’s stock performance is closely monitored by investors due to its implications for the overall telecommunications sector in India. Vodafone Idea has seen fluctuations in its share price influenced by financial results, industry changes, and regulatory frameworks. Understanding these trends is essential for current and prospective investors.

Current Market Situation

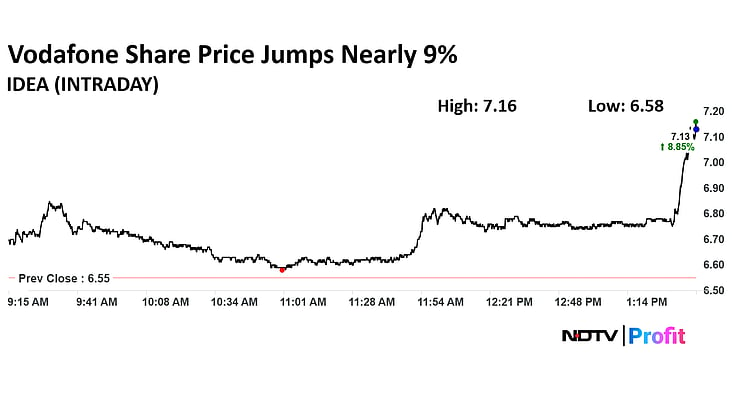

As of October 2023, Vodafone Idea’s share price stands at approximately ₹10.20, reflecting a volatile trading pattern in recent months. This volatility can be attributed to several factors, including ongoing competition with rivals such as Reliance Jio and Bharti Airtel, and the company’s struggles to maintain a strong subscriber base. Vodafone Idea reported a net loss of ₹1,500 crores in its latest quarterly earnings, which has dampened investor sentiment. Moreover, the company’s hefty debt burden remains a concern, with liabilities exceeding ₹1.9 lakh crores, compounding its operational challenges.

Regulatory and Financial Updates

The Indian telecom sector has been under scrutiny with regulatory changes pertaining to tariff rates and spectrum fees. Recent government discussions regarding the requirement for relief measures have sparked hope among investors that Vodafone Idea might receive necessary support. The company’s management is also actively working on strategies to enhance revenue through service diversification and improving customer experience.

Future Outlook and Investor Sentiment

Analysts are divided on the future trajectory of Vodafone Idea’s share price. Some foresee a cautious recovery if the company can navigate its financial hurdles and improve its service offerings. The 5G rollout and expansion into newer digital services could provide a potential upside to their business model.

Investor sentiment remains cautious but hopeful, particularly with the proposed government support. Investors are advised to stay updated on market trends, as the telecommunications industry is dynamic, and stock performance can change rapidly based on market and regulatory developments.

Conclusion

In conclusion, Vodafone Idea’s share performance remains a topic of interest amid its operational challenges and industry competition. Investors should monitor the company’s financial health, market movements, and regulatory changes closely. While the potential for recovery exists, risk management strategies are crucial in navigating investments in such a volatile environment.