Recent Trends in JioFin Share Price

Introduction

The JioFin share price has garnered significant attention among investors and analysts alike, especially given the current volatility within the telecom sector. With the rapid expansion of digital services in India and the prominent role that Jio Platforms plays in it, understanding the movements of JioFin shares is crucial for stakeholders. Recently, the market has seen fluctuations that could influence investor confidence and future trends.

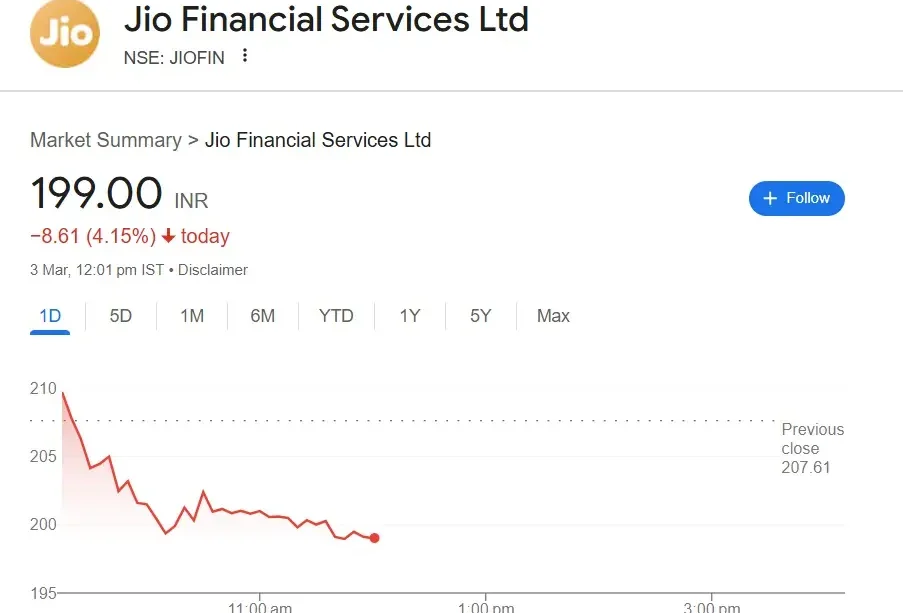

Current Market Status

As of October 2023, JioFin shares have exhibited considerable activity, with a notable uptick in trading volume. This follows reports indicating a 15% year-on-year growth in earnings, significantly outperforming market expectations. Analysts have highlighted the ongoing investments in technology infrastructure as a core driver behind this growth. On the other hand, external factors such as competitive pricing from rival companies and regulatory challenges pose potential risks that investors need to assess.

Factors Influencing Share Price

Several key elements are influencing the JioFin share price trajectory:

- Digital Expansion: Jio’s continuous investment in expanding its 5G infrastructure has been a pivotal factor that reassures investors.

- Consumer Demand: The growing consumer demand for digital services, especially in rural areas, has led to a substantial increase in the customer base.

- Market Competition: The presence of competition is fierce, with companies like Airtel and Vi constantly innovating. This drives Jio to enhance its offerings.

- Regulatory Environment: Potential changes in telecom regulations and tariffs could also impact price movements.

Conclusion

In conclusion, the JioFin share price remains a dynamic component of the Indian stock market, influenced by a blend of internal growth strategies and external market conditions. For investors, keeping a pulse on these developments will be vital as Jio continues to evolve in an ever-competitive landscape. As we approach the financial year-end, predictions suggest a cautious optimism, provided that key performance indicators continue to meet market expectations and that regulatory challenges are effectively managed.