Recent Trends in Federal Bank Share Price: An Overview

Introduction

The performance of bank stocks often serves as a barometer for the broader economic landscape, and the Federal Bank share price is no exception. As one of India’s leading private sector banks, Federal Bank’s share price is keenly observed by investors, analysts, and financial enthusiasts. Understanding fluctuations in its share price can provide insights into both the bank’s health and the economy.

Current Share Price Trends

As of October 2023, the Federal Bank share price stands at approximately ₹120, reflecting a moderate increase of about 4% over the past month. This uptrend follows several positive developments within the bank, including a sustained growth in net interest margin and an uptick in customer deposits, which have bolstered investor confidence. The bank’s proactive measures to enhance its digital banking services also play a significant role in attracting a younger clientele, further driving share performance.

Recent Financial Highlights

In its latest quarterly results, Federal Bank reported a net profit of ₹650 crores, a significant growth compared to the same quarter last year. This robust financial performance is credited to improved asset quality, with a non-performing asset (NPA) ratio of just 2.5%, which is among the best in its peer group. The bank’s efficiency in controlling costs and increasing operational effectiveness has contributed to this uplift, making it an attractive option for investors.

Market Influences

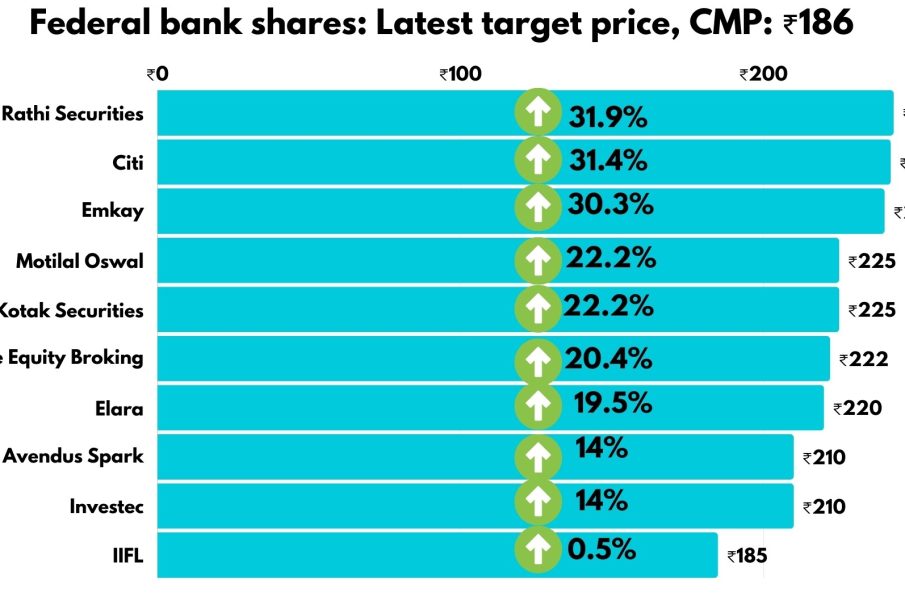

External factors also play a crucial role in determining the Federal Bank’s share price. With the Reserve Bank of India (RBI) maintaining a stable interest rate environment, banks are better positioned to lend and generate income. Furthermore, the comprehensive economic recovery post-pandemic boosts credit demand, thereby enhancing the outlook for banks like Federal Bank. Analysts remain optimistic about future performance, with many projecting a target share price of ₹135-₹140 within the next six months, contingent on the broader economic conditions and regulatory environment.

Conclusion

The Federal Bank share price continues to be a focal point for investors looking for opportunities in the robust Indian banking sector. Their strategic focus on digital transformation and cost management coupled with strong financial fundamentals makes them a sturdy player in the industry. As we move towards the end of 2023, the bank’s ability to sustain its growth trajectory amidst a changing economic landscape will be critical. Investors should keep a close watch on both internal performance metrics and external market conditions as they evaluate their positions in Federal Bank stock.