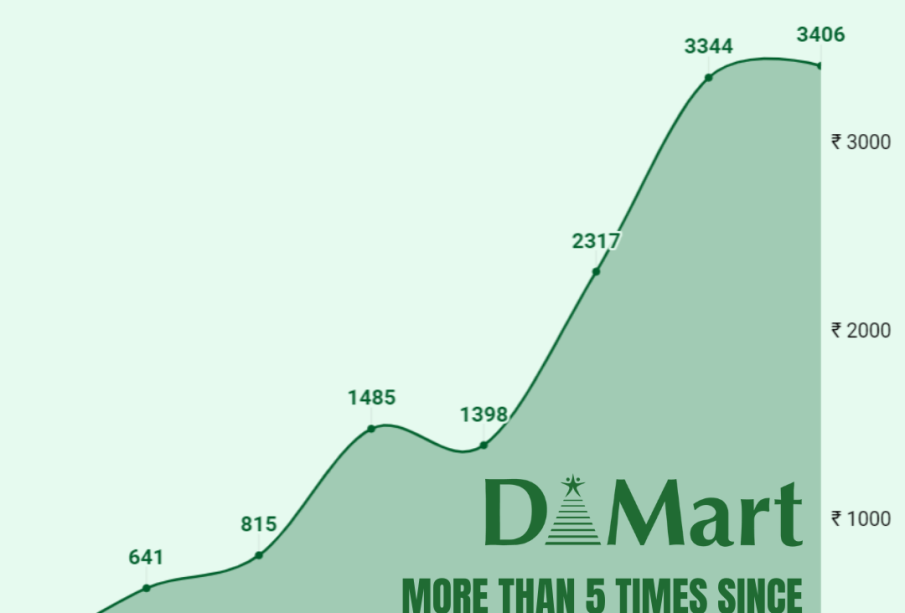

Recent Trends in DMart Share Price

Introduction

DMart, or Avenue Supermarts Ltd, is one of India’s leading retail chains known for its extensive range of household products at competitive prices. Its share price reflects not only the performance of the company but also trends in the broader retail sector in India. As of now, the stock market continues to be volatile, making it crucial for investors to stay updated on DMart’s share price as it can significantly impact their investment decisions.

Current Share Price Performance

As of late October 2023, DMart’s share price has shown fluctuations between ₹4,100 and ₹4,500 per share. The company’s shares were recently trading at approximately ₹4,350, representing a rise of about 2% from last week. This uptick comes amidst a growing consumer demand post the festive season, which is seen as a positive indicator for retail sales. Analysts note that DMart’s strategic expansion plans, including new store openings and innovations in online sales, have contributed to investor confidence.

Market Trends and Analysis

The Indian retail sector is experiencing a massive transformation with the rise of e-commerce and changing consumer purchasing habits. DMart has successfully adapted to these trends by enhancing its online presence and offering competitive prices both in-store and online. Recent financial reports have shown that the company’s revenues have been on an upward trajectory, with a reported increase of 15% in Q2 FY2023 compared to the previous quarter, further boosting its stock performance.

Furthermore, several analysts have issued buy ratings on DMart shares, driven by its strong fundamentals, including a solid balance sheet and efficient supply chain management. Institutional interest in DMart is also high, with numerous reports indicating accumulation of shares by major investment firms.

Investor Sentiments and Future Outlook

Looking forward, investors are optimistic about DMart’s ability to capitalize on the expanding retail market, particularly as the festive shopping season approaches. However, there are concerns regarding potential inflationary pressures and competition from both traditional retail and online players which could impact profit margins. Analysts suggest that maintaining a close watch on consumer trends and economic conditions will be essential for predicting future share price movements for DMart.

Conclusion

In summary, DMart’s share price remains a focal point for investors, reflecting overall market sentiments and retail performance in India. As the company continues to innovate and adapt to market demands, its shares are likely to respond positively in the long run. For investors, staying informed about the latest updates and market trends related to DMart is crucial for making well-informed investment decisions.