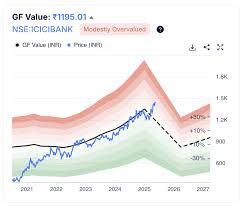

Recent Trends and Future Outlook for ICICI Bank Shares

Introduction

ICICI Bank has emerged as one of the leading private sector banks in India, significantly influencing the banking landscape. The performance of its shares is not only essential for existing investors but also serves as an indicator of the bank’s financial health and overall market conditions. In this article, we will delve into the current trends affecting ICICI Bank shares, recent performance metrics, and what the future may hold for investors.

Current Performance of ICICI Bank Shares

As of October 2023, ICICI Bank shares are trading at approximately ₹950. The stock has shown remarkable resilience, gaining over 20% in the last year, buoyed by robust financial results and a growing customer base. In the second quarter of FY 2023-24, the bank reported a net profit of ₹8,400 crores, reflecting an impressive 30% year-on-year growth. This performance is attributed to strong loan disbursements and improved asset quality.

Market Influences

The banking sector in India has benefitted from various factors contributing to the growth of ICICI Bank shares. The RBI’s stance on interest rates, which has remained conducive for lending, supported the bank’s financial performance. Additionally, government initiatives to boost economic recovery have resulted in increased consumer and business sentiment, further propelling demand for loans. Analysts note that the bank’s focus on digital banking and innovations has positioned it well to capture market share amid evolving consumer preferences.

Investment Outlook and Analyst Opinions

Market analysts have mixed views on the future trajectory of ICICI Bank shares. Some predict continued growth driven by high asset quality and lower provisioning requirements. According to experts, if the current trends persist, the stock could potentially reach ₹1,100 in the next year. However, concerns regarding potential economic slowdowns and global uncertainties could pose risks. It’s essential for investors to monitor external factors such as inflation rates and international markets, which may affect the banking sector.

Conclusion

In summary, ICICI Bank shares have shown impressive growth and continue to attract investor interest. With a strong performance backdrop and favorable market conditions, many believe the stock has the potential for further upside. However, as with any investment, careful consideration of market dynamics and economic indicators will be crucial in making informed decisions. Investors are advised to stay updated on the bank’s quarterly results and overarching economic indicators to navigate the evolving landscape effectively.