Recent Fed Rate Cuts and Their Economic Implications

Introduction

The recent decision by the Federal Reserve to cut interest rates has significant implications for the U.S. economy and global markets. As central banks often use rate cuts to stimulate the economy during slowdowns, understanding their impact is crucial for consumers, investors, and policy makers. As of October 2023, the Fed announced a 25 basis point rate cut, lowering the benchmark rate to a range of 4.50% to 4.75%, marking the first reduction in over a year.

Main Body

The rate cuts come in response to a mix of economic indicators that suggested a slowing economy. The Fed’s decision aims to invigorate consumer spending and encourage borrowing by making loans cheaper. According to recent data, inflation has shown signs of easing, with the Consumer Price Index (CPI) rising just 3.2% year-over-year in September, down from peaks of over 9% in mid-2022. This declining trend in inflation has provided the Fed some leeway to reduce rates without reigniting rampant inflation.

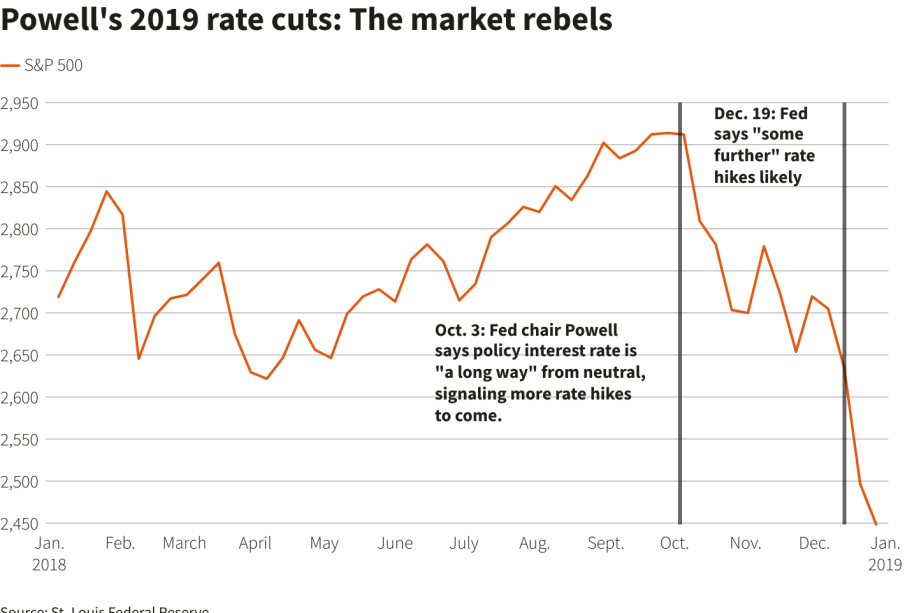

Economists predict that these rate cuts could lead to an increase in consumer confidence, as lower interest costs could translate to cheaper mortgages and business loans. Consequently, sectors like housing and consumer goods may see a positive uptick. Markets have reacted favorably, with stock indices rallying as investors digested the news. For instance, the S&P 500 surged by 2% in the days following the announcement, indicating a renewed interest in equity investments as the cost of borrowing decreases.

However, the implications of rate cuts are not universally positive. While consumers benefit from lower borrowing costs, businesses may find it challenging to navigate an uncertain economic landscape caused by potential further geopolitical tensions and ongoing supply chain disruptions. The risk of over-reliance on monetary policy to prop up the economy remains a concern among some economists.

Conclusion

The recent Fed rate cuts signify a strategic move to foster economic growth amidst challenges. While they present opportunities for consumers and investors, the long-term effects will depend on how effectively the economy responds to this stimulus amidst ongoing global uncertainties. Analysts suggest closely monitoring further economic indicators and Fed comments for any signs of future adjustments. As these developments unfold, the impacts of this rate cut will be a significant narrative in economic discussions over the coming months, influencing decision-making for both individuals and organizations.