Qualcomm Share Price: Trends and Insights

Introduction to Qualcomm Share Price

Qualcomm, a global leader in semiconductor and telecommunications equipment, has been closely watched by investors and technology enthusiasts alike. Understanding Qualcomm’s share price movements is crucial as it directly reflects not only the company’s performance but also global market trends in technology.

Current Performance and Trends

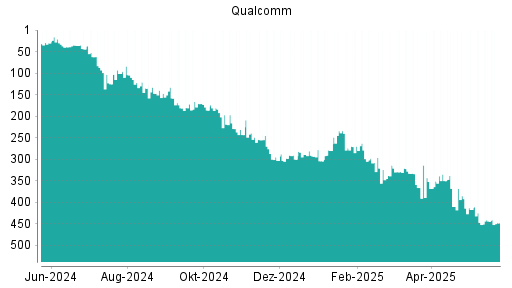

As of October 2023, Qualcomm’s share price is experiencing fluctuations influenced by various market factors including the global chip shortage, trends in 5G technology, and competition in the semiconductor space. Currently, Qualcomm shares are trading at approximately $125, reflecting a volatility of around 5% over the past month. Analysts remain optimistic about the company’s growth potential, especially in light of increasing demand for 5G infrastructure and mobile devices.

In recent earnings reports, Qualcomm showcased strong revenue growth, primarily driven by a surge in demand for smartphone chips and other wireless technologies. Investors had anticipated this growth, yet the company’s forward guidance has garnered mixed reactions, thus impacting its share price performance.

Impact of Market Conditions

Factors such as interest rates, inflation, and ongoing geopolitical tensions continue to influence investor sentiment. The semiconductor industry, which is highly cyclical, is seeing pressures from both pandemic recovery issues and an evolving landscape of supply chain management. Qualcomm, however, has been taking proactive measures to stabilize its supply chain and maintain a competitive edge, contributing positively to its stock outlook.

Future Outlook

Looking forward, analysts believe that Qualcomm’s expansion into new markets, including automotive technology and Internet of Things (IoT), will likely enhance its revenue streams. With an expected increase in demand for connected devices and smart technologies, Qualcomm is anticipated to continue its positive momentum in the upcoming quarters.

Conclusion

For investors and stakeholders, monitoring Qualcomm’s share price remains essential in understanding its value in an increasingly technology-driven world. With the ongoing advancements in 5G technology and the gradual recovery of semiconductor supply chains, Qualcomm’s strategic positioning is likely to play a key role in its stock performance. Investors should stay updated on market trends and company announcements to capitalize on potential growth opportunities.