Polycab Share: An Overview of Current Market Trends

Introduction

Polycab India Limited, a prominent player in the electrical wiring sector, has seen a significant rise in its share value over recent years. Founded in 1996, the company specializes in manufacturing cables and wires and has expanded its product portfolio to include a vast range of electrical products. Understanding Polycab’s share performance is crucial for investors who seek to capitalize on the growing demand for electrical products in India.

Current Market Performance

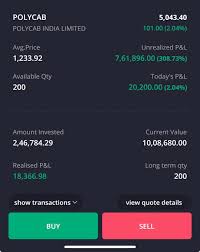

As of October 2023, Polycab shares are trading at approximately ₹2,450, reflecting a substantial increase compared to ₹1,800 at the beginning of the year. The company’s strong revenue growth and profitability have been primary drivers of this increase. Recent financial results from Q2 FY2023 showed a revenue growth of 20% year-on-year, reaching ₹3,000 crore.

Additionally, the company’s focus on innovation and expansion into newer markets has significantly boosted investor confidence. Analysts predict a bullish trend for Polycab shares, with estimates suggesting further appreciation as the company ramps up production to meet increasing domestic and international demand.

Factors Influencing Polycab Shares

Several factors contribute to the ongoing positive trajectory of Polycab shares. Firstly, the growing trend of infrastructure development in India, supported by government initiatives, has amplified the demand for electrical products. Secondly, Polycab’s strategic investments in technology and sustainable practices have positioned it as a leader in the industry.

Furthermore, the global shift towards renewable energy sources provides new opportunities for Polycab, particularly in providing cables for photovoltaic systems and other renewable applications. These emerging segments are expected to contribute to the company’s growth in upcoming years.

Conclusion

In conclusion, Polycab shares present a compelling investment opportunity, driven by robust market fundamentals and strategic initiatives. Investors are encouraged to keep an eye on the company’s financial health, market trends, and external economic factors that could influence its share performance. With a positive outlook for continued growth in the electrical sector, Polycab remains a key player to watch in the stock market for 2023 and beyond.