PhonePe: Transforming Digital Payments in India

Introduction

In recent years, digital payments have become an integral part of everyday transactions in India. Leading the charge is PhonePe, a mobile payment platform that has revolutionized how millions of Indians make payments. Founded in 2015, the platform has achieved remarkable growth, making it one of the largest players in the Indian fintech ecosystem. With the increasing shift towards cashless transactions, understanding PhonePe’s journey and its impact on the economy is crucial.

Growth and Features

PhonePe has seen a meteoric rise since its inception, processing transactions worth over $846 billion (approximately ₹63 lakh crore) as of 2023. This number reflects a significant surge fueled by the pandemic, which accelerated the adoption of digital payment solutions. The application was one of the first to utilize the Unified Payments Interface (UPI), a ground-breaking instant payment system developed by the National Payments Corporation of India (NPCI).

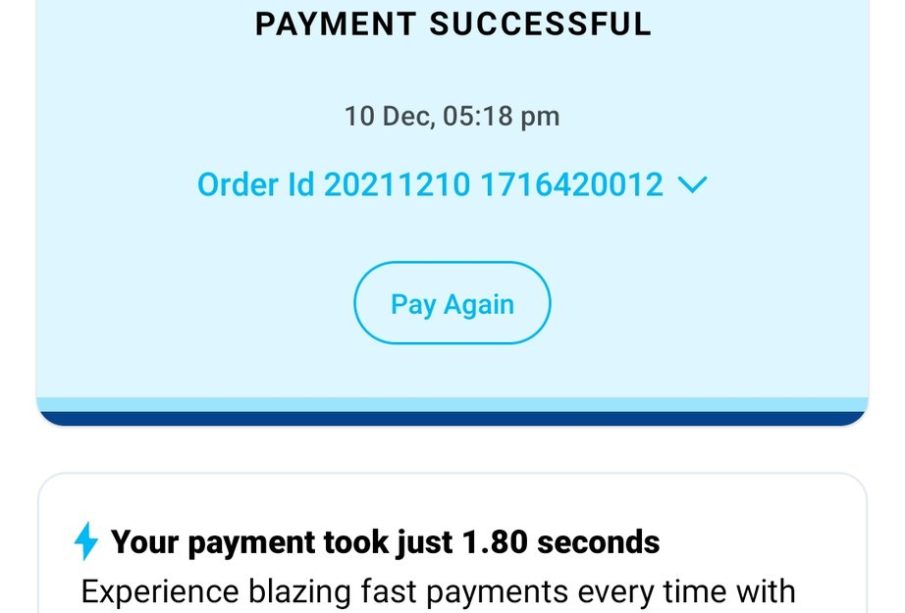

The platform offers a plethora of services, ranging from utility bill payments, recharges, and government payments to online shopping and merchant transactions. One of the standout features is its ability to facilitate seamless peer-to-peer transactions, enabling users to send and receive money with just a few taps on their phones. Additionally, with the introduction of features like PhonePe Switch, users can access various third-party applications directly through the PhonePe platform, enhancing the user experience further.

Challenges and Future Outlook

Despite its success, PhonePe faces stiff competition from other digital payment platforms like Paytm, Google Pay, and Amazon Pay. As the fintech sector in India continues to grow, maintaining user trust and ensuring transactional security will be paramount for PhonePe. Moreover, regulatory challenges and the need for continuous innovation are persistent hurdles that the company must navigate effectively.

Looking ahead, PhonePe is poised for further growth by expanding its offerings such as insurance, loans, and investment products. The increasing internet penetration in rural areas, coupled with rising smartphone usage, presents an enormous opportunity for the platform to reach untapped markets.

Conclusion

PhonePe’s journey from a startup to a leader in the digital payments space is remarkable, reflecting the broader changes in consumer behavior and the Indian economy. As cashless transactions become the norm, PhonePe will play a pivotal role in shaping the future of fintech. With its innovative features and growing user base, the platform offers a glimpse into the potential of digital financial services in India.