PhonePe: A Revolution in Digital Payments in India

Introduction

In recent years, digital payment platforms have transformed the financial landscape in India, enabling seamless transactions for millions of users. Among these platforms, PhonePe has emerged as a significant player, offering a comprehensive suite of digital financial services. Especially since the pandemic, the importance of digital payment solutions has surged, making PhonePe’s role in India’s economy even more critical.

What is PhonePe?

Launched in 2015, PhonePe started as a UPI-based application that enables users to make instant money transfers, pay bills, and conduct merchant transactions using their mobile devices. With over 400 million registered users and processing more than 1.2 billion transactions monthly, PhonePe has solidified its position as one of India’s top digital wallets.

Recent Developments and Features

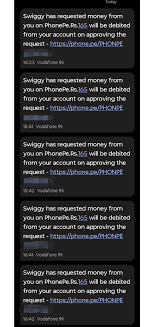

As of 2023, PhonePe has expanded its services beyond basic money transfers to include insurance, investments, and loans, effectively transforming into a holistic financial platform. Recently, it introduced a new feature allowing users to invest in stocks directly through the app, marking a significant step towards consolidating financial services. Additionally, PhonePe has been focusing on enhancing user security with advanced encryption and features like biometric verification to protect transactions.

Collaboration and Growth

In 2022, PhonePe received significant investments from various global funds, valuing the company at around $5.5 billion. These investments have allowed PhonePe to rapidly expand its footprint, not just in urban areas but also in rural markets. Partnerships with various merchants, e-commerce platforms, and local businesses have also bolstered its user base, making it accessible to an even wider audience. Furthermore, the app is widely accepted by small and medium enterprises across the country, allowing them to cater to a tech-savvy customer base.

Conclusion

The significance of PhonePe in today’s digital economy cannot be overstated. By continuing to innovate and adapt to user needs, PhonePe is not only streamlining financial transactions but also empowering individuals and small businesses across India. As the digital payments ecosystem evolves, PhonePe is poised to play a pivotal role, laying the groundwork for even more advanced financial solutions in the coming years, stretching into services we have yet to imagine. For consumers and merchants alike, staying informed and engaged with platforms like PhonePe is crucial to harnessing the full potential of digital finance.