PG Electroplast Share Price: Current Trends and Analysis

Importance of Tracking PG Electroplast Share Price

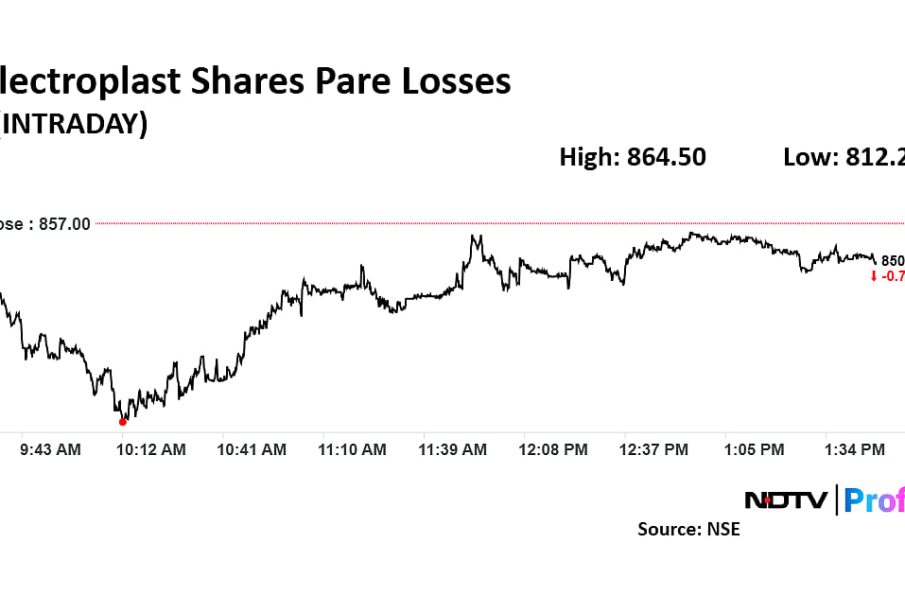

PG Electroplast, a notable player in the electronics and manufacturing sectors, has seen various changes in its share price over recent months. Understanding its share price movements is crucial for investors and stakeholders aiming to assess market trends and make informed decisions.

Current Market Position

As of October 2023, PG Electroplast’s share price is fluctuating around INR 280 mark, having experienced a significant rise of approximately 15% over the last quarter. This surge can be attributed to a combination of factors including the company’s recent financial results, strategic partnerships, and the overall growth in the electronics market.

Recent Financial Performance

In its latest quarterly results, PG Electroplast reported a net profit increase of 20% year-on-year, showcasing robust demand for its products. This performance has not only instilled confidence among investors but has also attracted new investors looking for promising opportunities in the stock market.

Market Analysis and Predictions

Market analysts suggest that PG Electroplast’s share price may see further ascension in the upcoming months, particularly with the anticipated growth in sectors such as consumer electronics and renewable energy solutions. Industry experts forecast a potential target price of INR 320 for the near future, contingent on continued positive financial performance and market conditions.

Conclusion: What Investors Should Know

For potential investors, keeping an eye on PG Electroplast’s share price is vital, especially considering the rapid transformations in the electronics industry and its implications on stock performance. As always, investors are advised to conduct thorough research and consider expert predictions before making investment decisions.