Paytm share price: Today’s intraday movement and key metrics

Why paytm share price matters

Paytm, listed as One97 Communications, is closely watched by retail and institutional investors for signals about the fintech sector and broader market sentiment. Tracking the paytm share price intraday helps traders assess volatility, liquidity and momentum, and compare current levels with key technical benchmarks such as moving averages and 52‑week ranges.

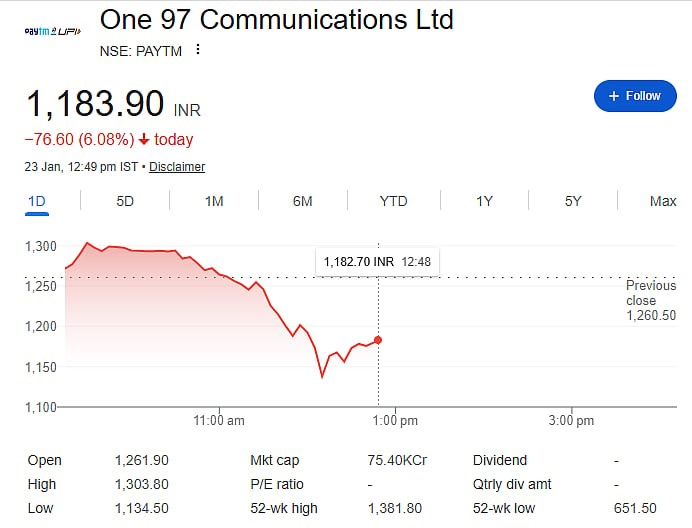

Main market data and intraday movement

Opening and previous close

Sources provide slightly different open levels for the session: NSE/BSE data records an open of ₹1164.90 while Yahoo Finance lists an open of ₹1137.50. Both NSE/BSE reporting and Yahoo show the previous close at ₹1168.10.

Intraday high, low and ranges

Intraday ranges vary by source. NSE/BSE data notes the stock traded between ₹1112.20 and ₹1164.90 during part of the day. Brokerage Dhan reports a broader session high of ₹1183.00 and a low of ₹1023.80, with an average traded price of ₹1119.55. Yahoo Finance records the day’s range as ₹1023.80 to ₹11243.80, and a 52‑week range of ₹651.50 to ₹11381.80.

Volume and technical context

Yahoo Finance reports volume of 8,289,818 shares for the session, indicating notable trading activity. The 50‑day moving average (50 DMA) is reported by Dhan at ₹1289.46, which sits above the reported intraday prices, suggesting the stock remains below its short‑term average. Traders often view such gaps to the 50 DMA as an indicator of near‑term downward pressure until a sustained move above that level occurs.

Conclusion and implications for readers

The several data points for the day show Paytm experiencing intraday volatility, with a range that in some feeds extended from about ₹1023.80 to over ₹1183.00 and occasional prints up to ₹11243.80. Volume near 8.3 million shares reflects active interest. For investors, key items to watch are whether paytm share price can reclaim and hold above the 50 DMA (₹1289.46) and how intraday ranges settle relative to the 52‑week spectrum. Given the divergence in reported highs and opens across sources, readers should consult their preferred exchange feed or broker for real‑time quotes before making trading decisions.