Patel Retail IPO Allotment Status: What Investors Need to Know

Introduction

The much-anticipated Patel Retail IPO, which concluded its bidding process recently, has garnered significant interest among investors and market watchers. As the retail sector in India continues to expand, understanding the IPO allotment status becomes crucial for prospective investors eager to enter this burgeoning market. This article provides an overview of the current allotment status and what it means for stakeholders.

IPO Overview

Patel Retail launched its Initial Public Offering (IPO) from October 3 to October 5, 2023, aiming to raise approximately ₹500 crore. The IPO attracted strong demand, with subscriptions reported at over 15 times on the final day. The retail segment alone saw a subscription rate of over 25 times, reflecting robust investor confidence in the company’s growth prospects.

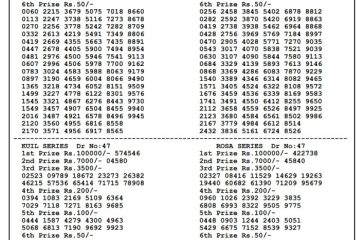

Allotment Status

As of October 10, 2023, the allotment status of the Patel Retail IPO has been made available. Investors can check their allotment status through the official registrar’s website, Kfin Technologies, or through the Bombay Stock Exchange (BSE). Typically, the allotment results are available within 3 to 4 days after the closing date of the IPO, and investors are advised to have their application number and PAN handy for a smooth inquiry.

Expected Impact on Market

With the allotment announcement expected soon, market analysts are keeping a close eye on the potential listing price of Patel Retail shares. Given the high subscription levels, analysts predict a healthy premium on the listing day, contributing positively to the ongoing buzz in the retail sector. Furthermore, a successful listing could boost investor sentiment towards other upcoming IPOs in the market.

Conclusion

The Patel Retail IPO has marked a significant milestone in the Indian IPO landscape, emphasizing the growing interest in the retail sector. As investors await the allotment status, the anticipation is palpable in the market. For potential investors, keeping updated with this status will be essential, not only for financial opportunities but also for understanding the dynamics of the retail market in India.