Overview of Shringar IPO Allotment Status

Introduction

Shringar IPO allotment status has become a significant topic of interest among investors as the company prepares to enter the stock market. With initial public offerings (IPOs) being a lucrative avenue for investment, understanding how allotments are handled is crucial for potential investors. The Shringar IPO is particularly relevant given the growing demand for shares in new companies and the potential for substantial returns.

Details of Shringar IPO

The Shringar IPO opened for subscription on October 10, 2023, and closed on October 12, 2023. The company aims to raise approximately ₹700 crore through this IPO, which includes fresh issuance and an offer for sale. The price band for the shares was set between ₹200 and ₹250, and the IPO has seen a solid response from investors, with ample interest from both institutional and retail segments.

Allotment Process

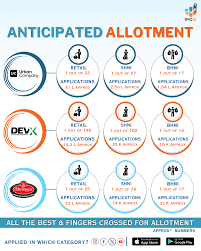

The allotment of Shringar shares is expected to take place shortly after the IPO closure. Investors can check their allotment status on the official registrar’s website or through their respective stock brokerage accounts. Those who have applied for the IPO can use their application number or PAN to track their allotment. Typically, the allotment status is announced within a week of the IPO closure.

Market Response and Projections

The positive sentiment surrounding the Shringar IPO is reflective of the current market environment, where investors are eager to participate in promising companies. Analysts suggest that the substantial demand could drive the share price up once they begin trading on the exchange. Forecasts imply that if Shringar performs well after listing, it could encourage more companies to consider IPOs, further invigorating the market.

Conclusion

The Shringar IPO allotment status holds great significance for investors looking to maximize their returns in the ever-evolving stock market. As the initial public offerings gain momentum, prospective shareholders must stay informed about their allotment status. With the right information and anticipation of future market behavior, investors can strategically position themselves to benefit from the Shringar IPO and similar opportunities in the future.